- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Gold price little changed in a subdued session

Gold price little changed in a subdued session

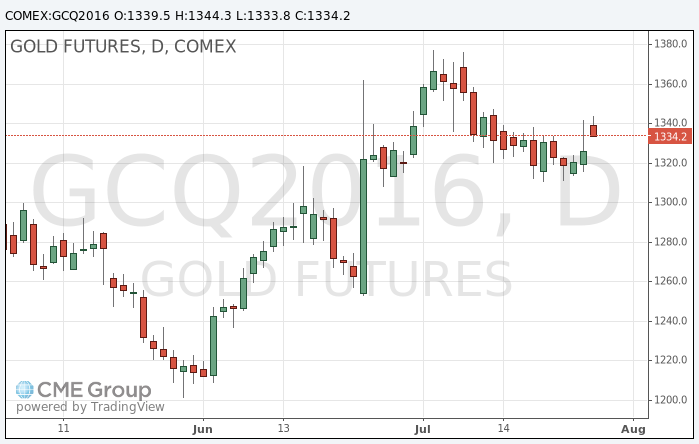

In the past few hours, the price of gold retreated from a two-week high reached after the Federal Reserve refrained from any hints of a rate hike at the next meeting in September.

On Wednesday, the Federal Reserve left interest rates unchanged and said that short-term risks to the US economic outlook declined. Nevertheless, the central bank did not give any indication regarding the rate increase in the near future.

Futures on the federal funds currently evaluating the likelihood of a rate hike in September to 18%, below 22% the day before. The probability of a hike in December is now 43% compared to 52% at the beginning of the week.

The precious metal is sensitive to higher interest rates in the United States. The gradual increase of the rate shall be less of a threat to the gold price than a series of sharp rises.

Daniel Brizeman, an analyst at Commerzbank, observes that the Fed decision not to change interest rates positively contributed to the rise in prices.

"The opportunity costs for gold remain low, - he said -. It is surprising that gold has not gone up even more."

"I think they (Fed) will wait a little longer to follow the events in Europe, before making a decision - says Bernard Dada, an analyst at Natixis -. If these events would be disastrous, then, I think they need more time to raise rates. "

Brizeman and Dada expect the next rate hike in December.

The Bank of Japan will announce its decision on monetary policy on Friday, with economists expecting further easing it. Softer monetary policy will mean that Japan's economic problems persist, prompting investors to buy safe-haven assets, including gold.

The cost of the August gold futures on COMEX fell to $ 1333.80 per ounce.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.