- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Asian session review: usd stabilized

Asian session review: usd stabilized

The Australian dollar was supported by strong iron ore prices and US dollar weakness. Also, the Australian currency rose by about 2% contrary to RBA decision to lower interest rates by 25 basis points to a record low of 1.50%.

Data on the index of activity in the service sector of Australia AiG show an incrase to 53.9 points, which is higher than the previous value of 51.3. Increased activity in the Australian services sector for the third consecutive month. Of the five sub-indices of the sector the highest growth was observed in the sector of sales to 59.4, the strongest level since August 2015. Deliveries rose by 6.0 points to 54.2, and inventories increased by 6.2 points to 52.8 points.

New orders remained stable at 52.2, while employment decreased by 3.1 points to 50.0 points.

Three of the nine sub-sectors were stable. Retail trade rose to 65.0, the finance and insurance to 62.0 and services to 53.2. Other sub-sectors oshowed a decline: wholesale to 48.9, personal and entertainment services to 46.7. The weakest growth rate observed in the sub-sector of transport and storage 33.6 points.

In China, Caixin services PMI fell in July to 51.7 from 52.7 the previous value. The index was also lower than the official data on business activity index of the services sector, which amounted to 53.9 points.

Caixin PMI is a leading indicator of China's state sector services. A value above 50 indicates growth, while falling below this level indicates contraction.

All index categories showed signs of deterioration. The greater deterioration observed in the employment category, which kept growing in the last three months.

The yen is trading near the yesterday's high as the Japanese government measures do not meet market expectations. The total amount of the stimulus program amounted to Y28 trillion and it became one of the most significant for Japan in the aftermath of the global financial crisis.

The US dollar traded in a narrow range against the euro, after yesterday's significant decline, helped by investors' flight from risk, as well as the widespread weakening of the US currency due to recent disappointing GDP report. Investors are concerned that the weak GDP data will reduce the likelihood of tighter monetary policy of the Fed. Today futures on interest rates suggest 18% probability of rate hike in September and 35% probability in December.

Markets gradually switched to the data on US labor market, which will be published on Friday. Some investors believe that the employment data will be strong, so that the Federal Reserve in the next few months will be able to make a rate hike.

Today, the US will release the index of business activity in the services sector from the Institute for Supply Management. The indicator is the result of a survey of about 400 companies from 60 sectors across the United States, including agriculture, mining, construction, transport sector, communications, wholesale and retail companies. The index consists of four equally weighted components: business activity, new orders, employment, suppliers and shipping. ISM index value greater than 50 is usually considered as an indicator of the growth of industrial activity, but less than 50, respectively, falls. It is expected that the index fell to 56.0 from 56.5 in June.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1200-05 range

GBP / USD: during the Asian session, the pair was trading in the $ 1.3300-05 range

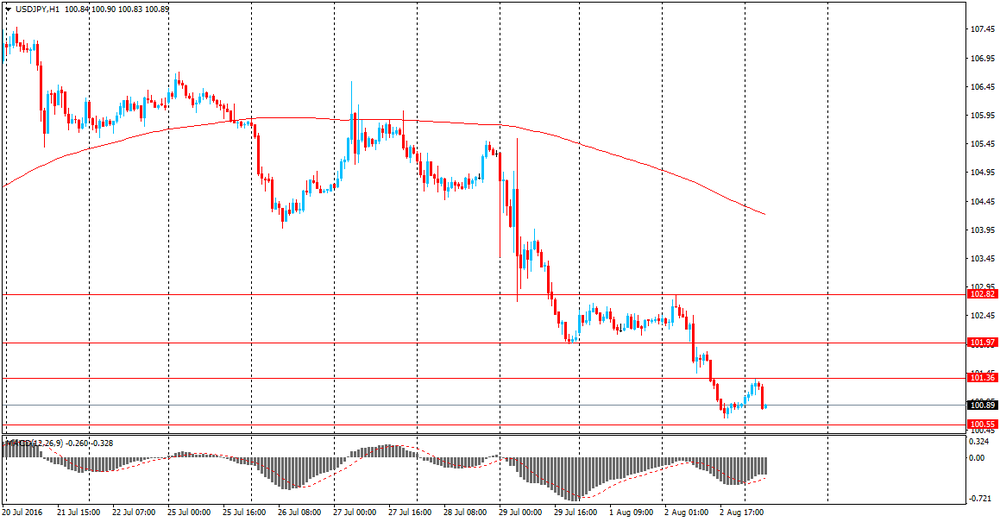

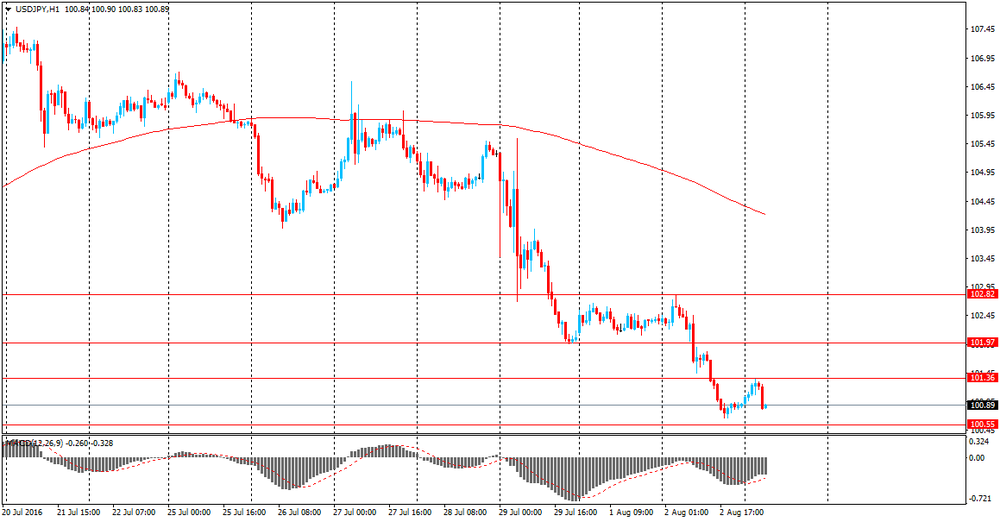

USD / JPY: during the Asian session, the pair was trading in Y100.75 - 101.05 range

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.