- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Oil prices continued to rise

Oil prices continued to rise

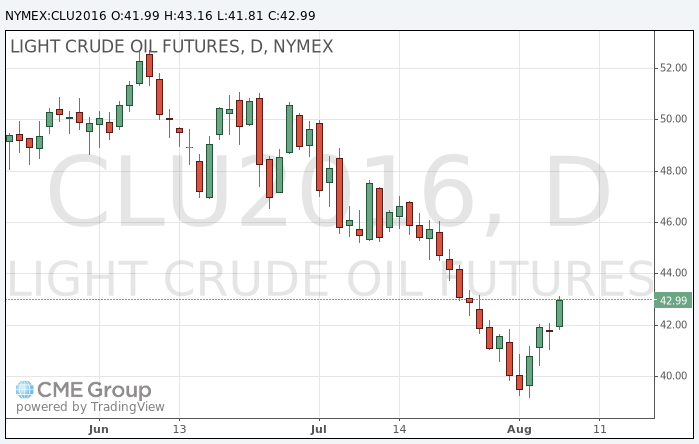

Oil prices continued to rise after a report that a number of OPEC members have renewed calls to limit production, but analysts warned of downside maintaining fundamental factors that led to the fall of oil prices.

the prices rose after the message in the Wall Street Journal mentioned that some OPEC members urged again to freeze production at current levels, to limit the supply, which consistently exceeds demand.

Qatar's Energy Minister said on Monday that the oil market is moving to restore the balance.

At the same time, excess oil and petroleum products continues to put pressure on the market.

Fuel exports from China in July rose more than 50 percent on an annual basis to a record monthly figure of 4.57 billion tons, official data showed.

"It would be surprising if we quickly reached the level of $ 60 per barrel, - said Bjarne Shildrop analyst at SEB. There is a lot of oil and we need no more."

The number of drilling rigs in the US increased the sixth week in a row to 381, while investors increased bets against the strengthening of oil prices.

Due to a number of factors, analysts have warned that global markets have not coped with the physical excess, which could again lead to a fall in prices before the beginning of a sustainable recovery.

The cost of the September futures on WTI rose to 43.16 dollars per barrel.

September futures price for North Sea petroleum mix of mark Brent fell to 45.56 dollars a barrel on the London Stock Exchange ICE Futures Europe.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.