- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Asian session review: the pound fall in anticipation of manufacturing data

Asian session review: the pound fall in anticipation of manufacturing data

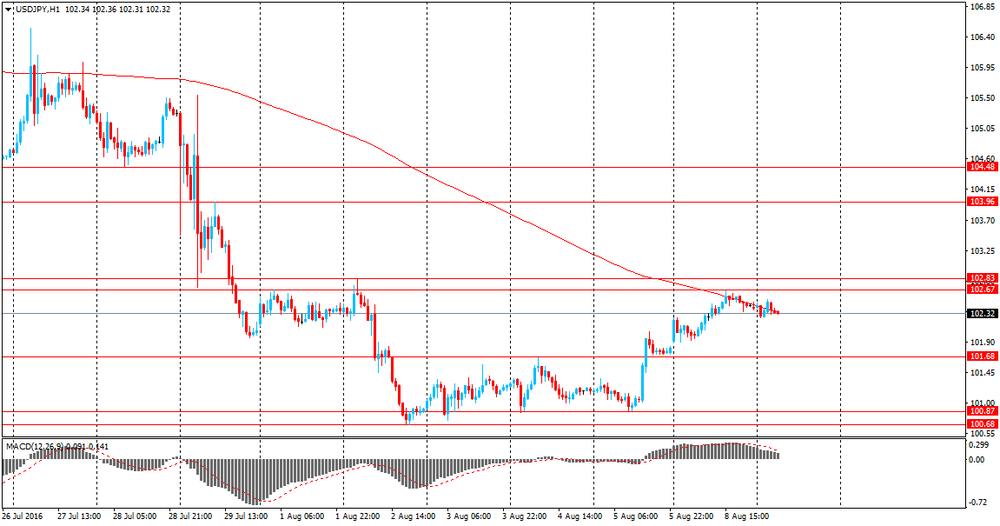

During today's Asian session, the US dollar traded in a narrow range against the euro and the yen, while maintaining stability.

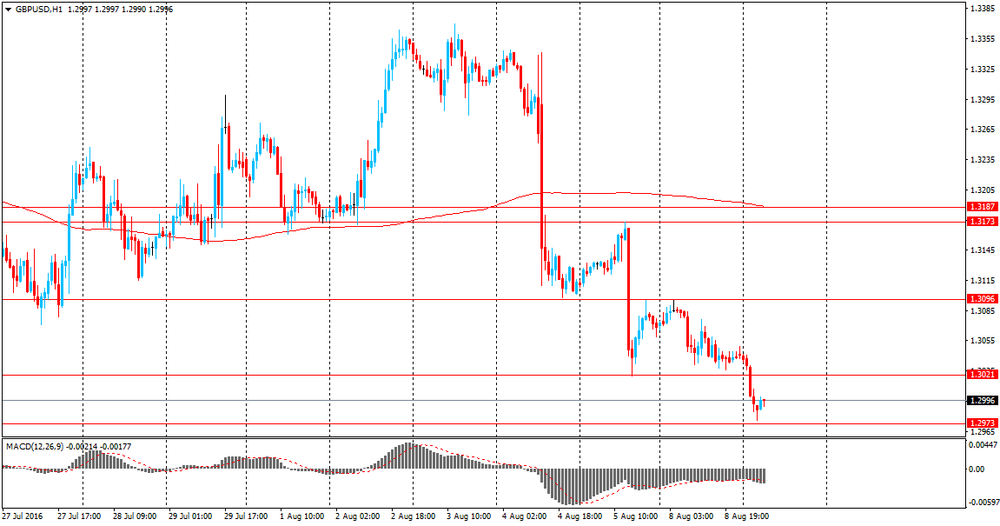

The pound was lower against the US dollar, despite the positive data on retail sales from the UK. According to British Retail Consortium retail sales increased by 1.1% year on year. Analysts had expected a decline to -0.7%. The previous value was also negative and amounted to -0.5%.

A report on retail sales, published by the British Retail Consortium, estimates changes in the actual retail sales companies, members of the consortium on the basis of regularly provided reliable information. This indicator shows the trend in the retail sector.

The BRC report states that recorded growth in retail sales is contrary to the UK talk about slowing consumer spending after Brexit. The growth of retail sales in July was the strongest since January of this year.

Also, the course of trading was influence by pricing in of today's statistics on industrial production in the UK. It is projected that by the end of June, industrial production increased by 0.2% in monthly terms and by 1.6% y/y. Meanwhile, production in the manufacturing sector is likely to contract by 0.2% in the month and increased by 1.3% per annum.

The Australian dollar has weakened since the beginning of the session, as the published results of the latest survey conducted by NAB showed that the index of business conditions in Australia fell in July to 8 with the previous value of 11, and the index of confidence in the business community dropped to 4 from 5 June.

Business conditions and confidence in business circles in Australia worsened amid growing uncertainty over the long-term prospects for the Australian economy.

NAB chief economist Alan Oster said the long-term risks are increasing, and it is likely to force the Reserve Bank of Australia to lower interest rates twice this year. Oster also said that short-term trends in the economy are satisfactory.

The Consumer Price Index of China, published by the National Bureau of Statistics of China, increased by 0.2% in July after falling 0.1% the previous month. This had an influence on commodity currencies. Analysts had expected an increase of 0.1%. In annual terms, the inflation indicator rose 1.8%. The pace of consumer price growth slowed slightly compared with +1.9% in June. The main factor that put pressure on the annual inflation was slowing food prices.

The result is a detailed summary of the data of urban and rural indices of consumer prices. The purchasing power of the Chinese currency is reduced under the influence of inflation. CPI - a key indicator of inflation and changes in purchasing trends. A decline in the consumer price index is a sign that inflation is becoming a destabilizing factor in the economy and could potentially provoke the People's Bank of China to tighten monetary policy and fiscal policy. In general, a high value is positive for China's currency.

Inflation remains well below the maximum target of 3% this year, giving the central bank room for easing monetary policy against the backdrop of the economic downturn.

Yu Qiumei, Senior Statistician at National Bureau of Statistics of China noted that a great influence on prices in the last month had heavy rains and flooding of the Yangtze basin. "Powerful rains significantly affected the processes of production and transport of fresh vegetables, which led to a rather strong increase in their prices in a number of regions".

Also, the National Bureau of Statistics of China released data on producer price index, which in July fell by 1.7% after falling 2.6% in June. Analysts had expected a decline to -2.0%

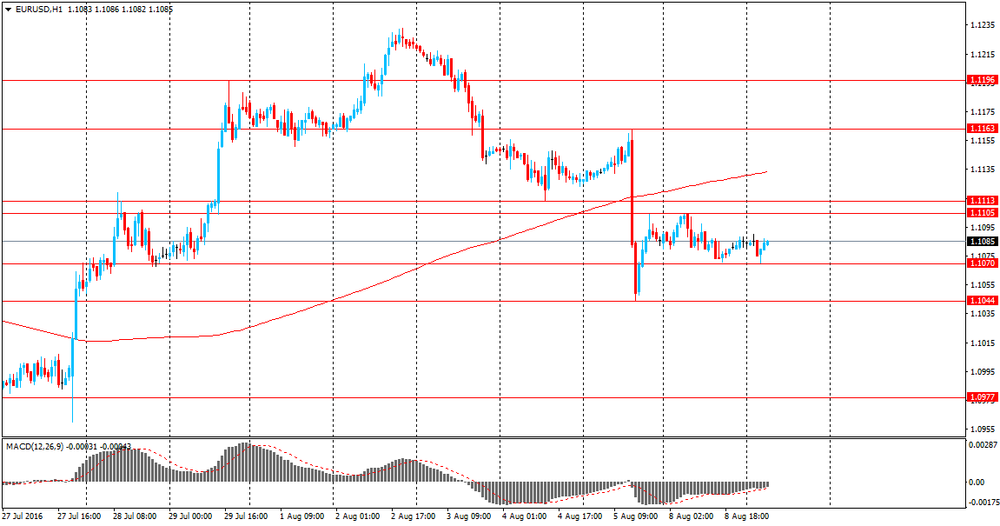

EUR / USD: during the Asian session, the pair was trading in the $ 1.1070-75 range.

GBP / USD: during the Asian session, the pair was trading in $ 1.2965-90 range.

USD / JPY: during the Asian session, the pair was trading in Y102.25-102.45 range.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.