- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Asian session review: the dollar weakened

Asian session review: the dollar weakened

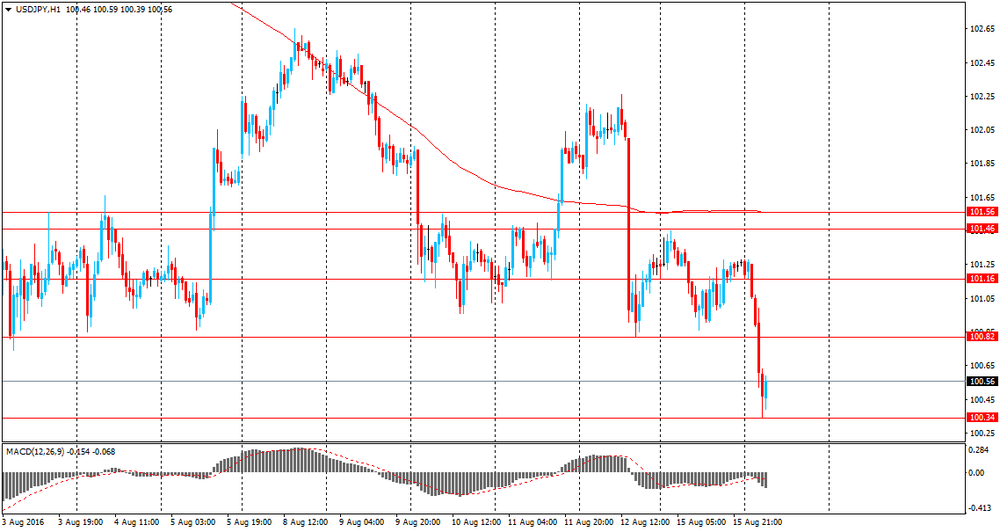

During the Asian session, the yen strengthened against the dollar and other major currencies. According to some analysts the decline of USD / JPY to a one-month low could be due to low trading volumes and sales by exporters. During the session the pair reached the Y100,20 level.

Also the weakening dollar hit by the extremely weak data on US retail sales, which increased doubts about the fact that the economy is not so strong that the Fed will raise interest rates soon. According to the futures market, the probability of a Fed hike in September is 12%. Meanwhile and in December is estimated at 41.3% against 44.9% on Friday.

Now, investors' attention shifted to today's report on inflation in the US. In addition, on Wednesday are expected the protocols of the July FOMC meeting, which could also shed light on the central bank's plans for the timing of rate hikes.

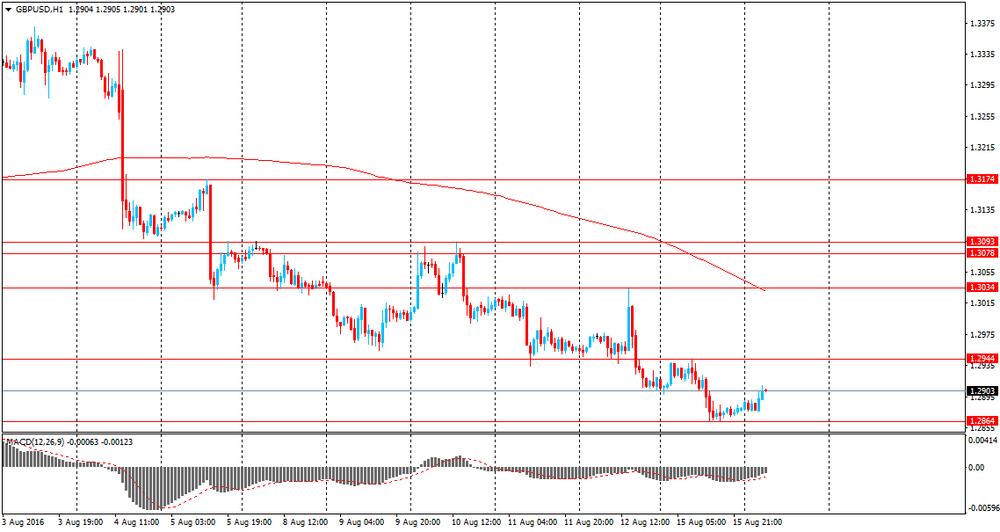

The pound fell against the US dollar. Later this week, economists will monitor the British inflation data, the number of applications for unemployment benefits, and retail sales for July to assess the initial effects of Brexit. Recall before the referendum GDP growth in the UK expected to be close to 0.6%, but now economists surveyed by Reuters forecast that the economy will shrink by 0.1%. If the estimates are confirmed, the UK economy will be in a technical recession. Reuters surveys also showed that, on average, analysts expect the Central Bank of England to cut rates by only 0.1% at the meeting in November.

The Australian dollar fell on negative data on vehicle sales in Australia. According to the report by the Australian Bureau of Statistics, in July, sales of new vehicles fell by 1.3%, after rising 3.5% in June. The value in June was revised from 3.1%. The annual sales on year increased by 1.6%, but the rate was lower than the previous value of 2.6%. The report on sales of new vehicles reflects the number of sales of new vehicles and is an indicator of consumer confidence.

During the session, the Australian currency gained after the publication RBA minutes as well as the weakening of the US dollar.

As stated in the minutes of the July meeting of the RBA, there is potential for faster growth in the Australian economy. Also in the minutes was noted that credit growth and housing prices slowed and recent inflation data confirm the weakening of inflation. RBA forecast GDP growth to be higher than the potential in the mid-2017

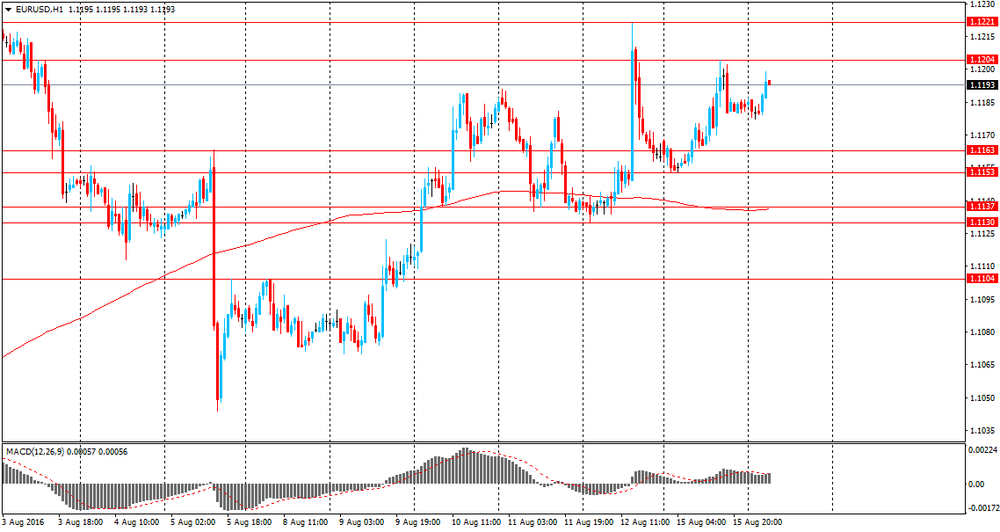

EUR / USD: during the Asian session, the pair was trading in $ 1.1180-1.1230 range

GBP / USD: during the Asian session, the pair was trading in $ 1.2880-1.2915 range

USD / JPY: the pair fell to Y100.20

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.