- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- European session review: the US dollar continues to rise

European session review: the US dollar continues to rise

The following data was published:

(Time / country / index / period / previous value / forecast)

The US dollar is rising moderately after the sharp rise on Friday as upbeat comments from US Federal Reserve's Janet Yellen on the state of the US economy have increased expectations of a rate hike.

During the annual conference of the representatives of the world's central bankers in Jackson Hole, Wyoming, Yellen said that the possibility of rate hike has increased in recent months against the backdrop of the recovery of the labor market and the economy.

Yellen not called the timing of rate increases, but the Fed Vice Chair Stanley Fischer said that her comments correspond to the growth expectations of the likely increase in 2016.

"The dynamics of the markets influenced not so much by Yellen as Fisher", - said Ayako Sera of Sumitomo Mitsui Trust Bank.

Futures on interest rates indicate that market participants estimate the probability of a rate hike in September at more than 30 percent instead of 18% before Yellen and Fisher showed FedWatch data from CME Group. The probability of a rate hike has grown to more than 60 percent in December from 57 percent on Friday.

According to analysts, now markets attach great importance to data on the number of jobs in the US (NFP), to be published on Friday.

US Dollar "increased significantly" after "comments that indicate a tendency to tighten policy," said analysts of Danske Bank and added that the employment data in the United States "will have a decisive influence on the short-term prospects for the US dollar."

The pound weakened against the US dollar while investors await important statistics from Britain.

On Tuesday, the Bank of England will publish data on lending to households and businesses in July, which will help understand whether the market disturbances have a negative impact on lending in the UK.

On Thursday, the PMI index will be released for the manufacturing sector. Markets hope that he will clarify how strongly the manufacturers recover.

EUR / USD: during the European session, the pair fell to $ 1.1166

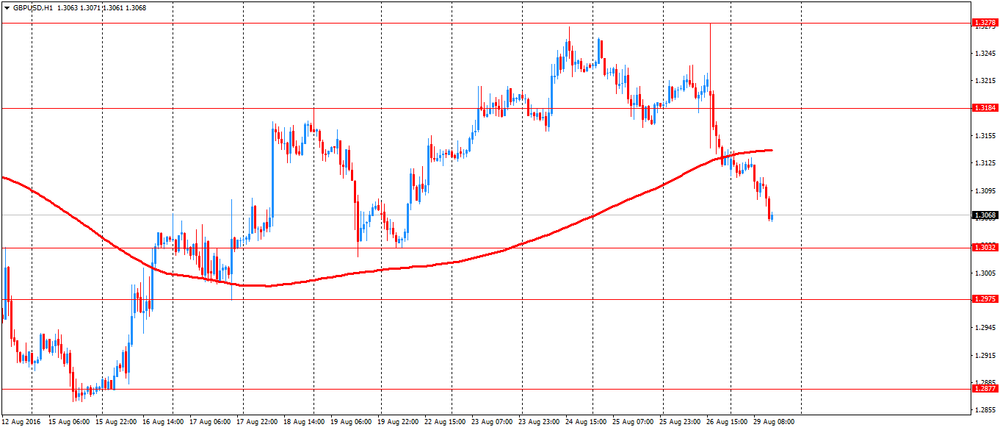

GBP / USD: during the European session, the pair fell to $ 1.3061

USD / JPY: during the European session, the pair rose to Y102.38 and retreated

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.