- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- European session review: US dollar rose against major currencies

European session review: US dollar rose against major currencies

The following data was published:

(Time / country / index / period / previous value / forecast)

-----

The US dollar rose against other major currencies, but gains are limited as investors remain cautious ahead of today's US data and the Federal Reserve meeting next week.

The Commerce Department reported that retail sales in the US fell by 0.3% compared with the previous month, more than the projected decline of 0.1%. The decline was the first in five months.

Meanwhile, the Ministry of Labor said that the number of initial unemployment claims in the US rose last week, less than expected, indicating improvement in the labor market.

Labor Department also reported that the index of producer prices in the US remained unchanged in August.

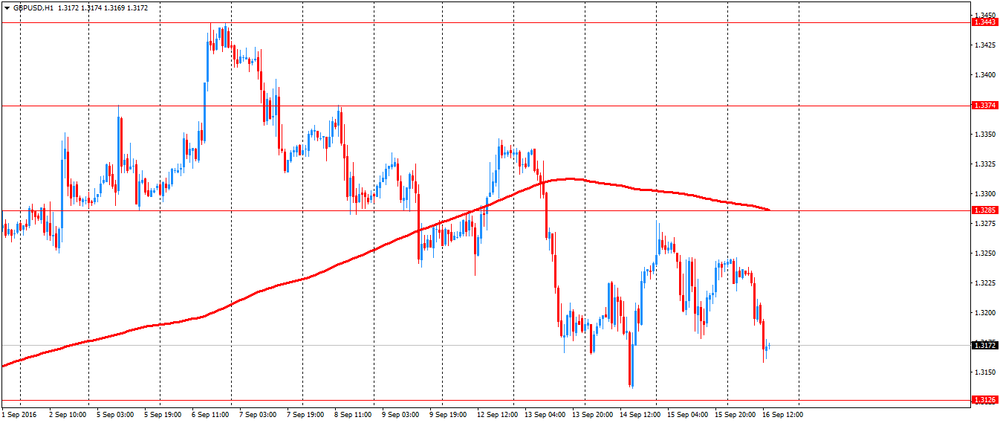

The pound fell against the dollar, while taking into account the fact that the British economic calendar for today is empty, investors will focus on the changes in risk appetite and US statistics. In addition, there may be some adjustment of positions before the weekend.

Market participants also continue to analyze the results of yesterday's meeting of the Bank of England. Recall, the Bank of England kept interest rates and quantitative easing unchanged at 0.25% and 425 billion pounds, respectively..

All nine members of the MPC voted unanimously for keeping the key rate. However, the statement was ambiguous, because the leaders of the Central Bank recognized that a number of short-term economic indicators in some ways turned out to be stronger than expected.

They also indicated that they expect at least a significant slowdown in economic growth in the second half of the year. At the same time, the Central Bank has signaled its readiness to lower the rate again if economic growth continues to slow in line with expectations.

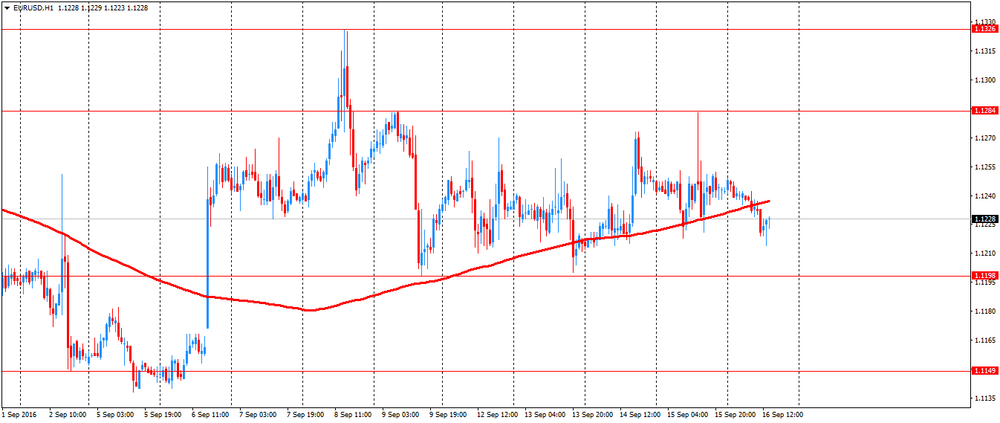

EUR / USD: during the European session, the pair fell to $ 1.1214

GBP / USD: during the European session, the pair fell to $ 1.3158

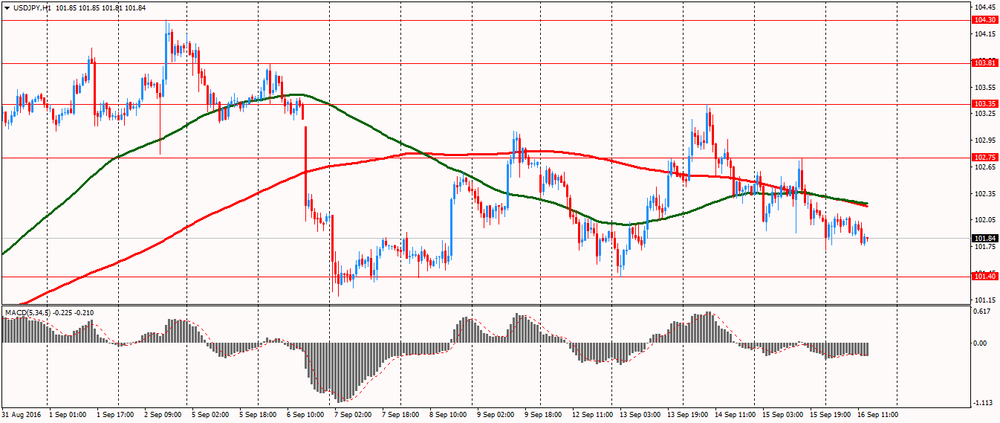

USD / JPY: during the European session, the pair is trading flat

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.