- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Asian session review: The Bank of Japan took measures that even the market can’t fully understand

Asian session review: The Bank of Japan took measures that even the market can’t fully understand

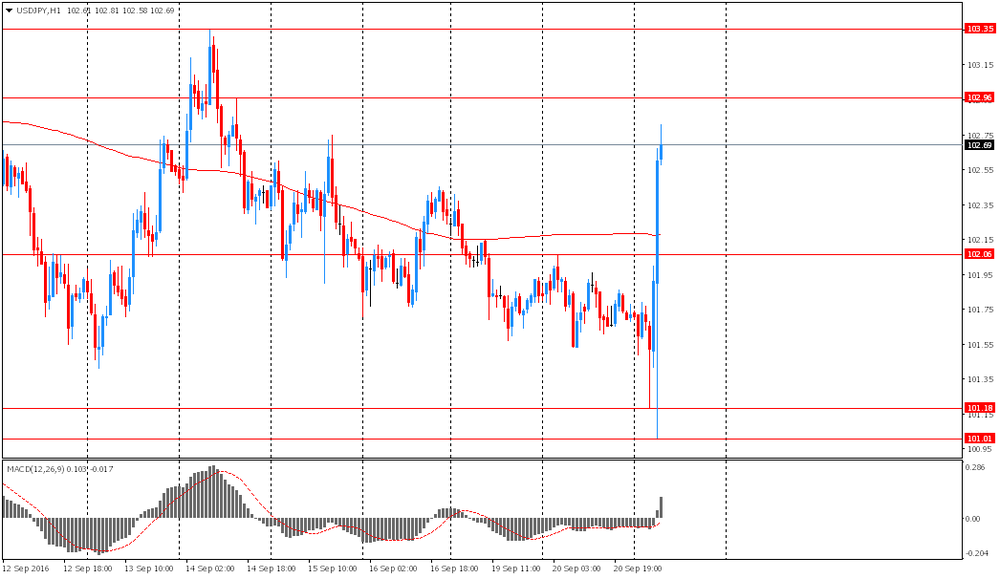

The yen has fallen by updating the session low despite the fact that BoJ did not change the intrest rate level, the regulator said that it will continue to increase monetary base, while inflation stabilizes above 2%. In addition, the Bank of Japan made a surprise move, targeting a level for the 10-year interest rates in order to strengthen the fight against deflation. This measure was adopted after the Bank management's assessment of existing measures which have not led to the achievement of inflation target of 2% for two years, as it was planned earlier. Also, traditionally the Bank of Japan announced its readiness to further reduce the negative interest rates on deposits.

Earlier today data on the trade balance of Japan was published. According to the report of the Ministry of Finance of Japan, the foreign trade deficit amounted to Y19,0 billion in August, but the forecast indicated a surplus of Y202,3 billion. In July, the trade surplus was Y513,2. Japan's exports fell by -9.6% compared to the same period of the previous year. Economists had expected a fall to -4.8%. Reduced exports continues the eleventh consecutive month. Exports to Europe decreased by 0.7% in the US to 14.5%, while in China -8.9%. Year-on-year imports fell by -17.3% compared to August of the previous year.

Today, a key event for markets will be the announcement of the Fed's decision on monetary policy. Mixed US data recently clouded the prospects of a Fed hike. Judging by the futures market, investors assess the probability of a hike at this meeting at only 18%.

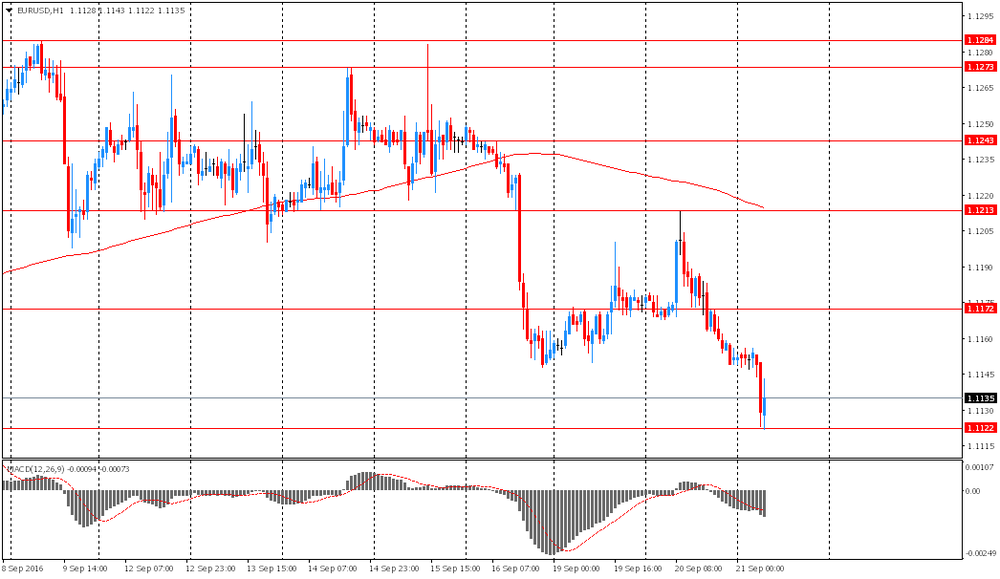

EUR / USD: during the Asian session the pair fell to $ 1.1120

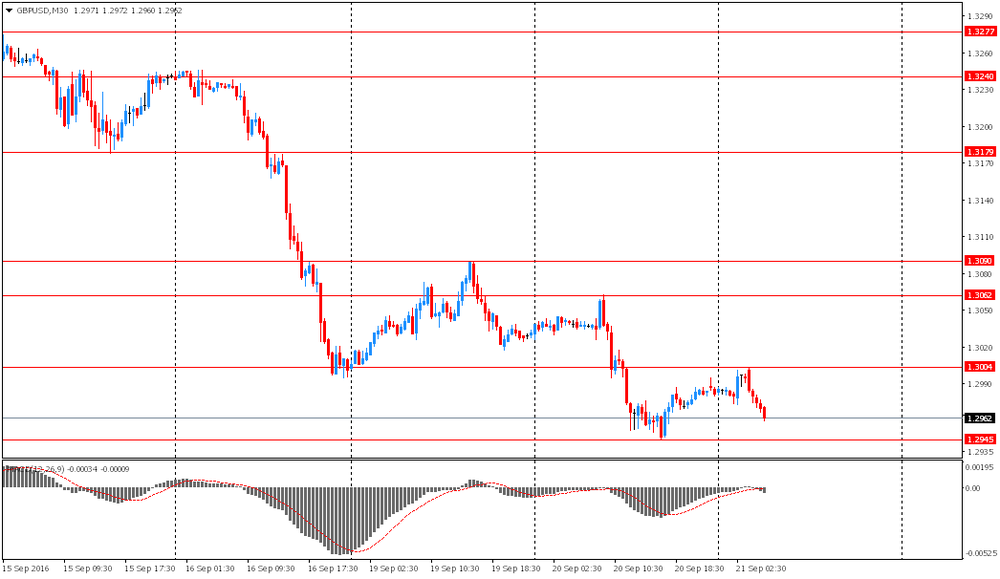

GBP / USD: during the Asian session the pair fell to $ 1.2945

USD / JPY: rose to Y102.80 in the Asian session

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.