- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- GBP: A Strategy For A 'Big If' Trade - Nomura

GBP: A Strategy For A 'Big If' Trade - Nomura

"Reminded that the single market access is important, but not on top.

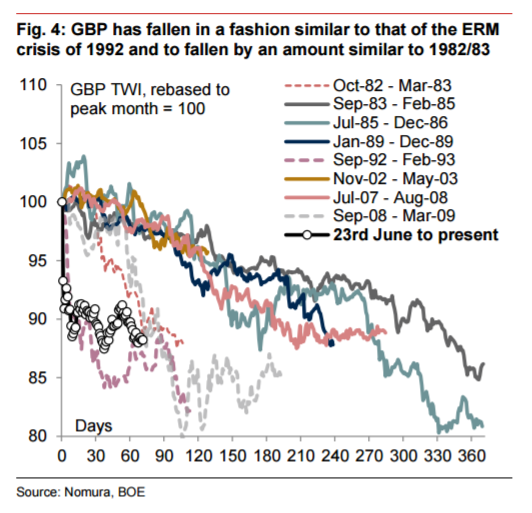

The speech by Theresa May over the weekend told us that the timing of Article 50 is to be "no later than the end of March next year." This provided clarity as to when, but was not much of a surprise given several reports that alluded to that possibility in the weeks prior. The market view this morning was that the big themes of Brexit were touched on and offered little hope of a single market access outcome, given the emphasis on immigration and sovereignty controls used.

GBP continues to be a difficult market to trade, with political headlines causing the recent fall but also a deterioration of wider market risk sentiment perhaps playing part of the trend lower.

If the negative European financial developments continue, this could accelerate GBP weakness, especially against USD, while the US political risk declined somewhat after the first debate (still uncertain, though).

Assuming a widespread market tail risk event doesn't materialize (also a big IF), given these low levels the value trade remains to hold Long GBP in the medium term; however, timing remains important, as we remain in a range-bound environment whilst the Tory party conference is not yet over, so we would wait for the dust to settle before doing so and look to see how Services PMI is on Wednesday".

Copyright © 2016 Nomura, eFXnews™

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.