- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Asian session review: USD/JPY significantly lower

Asian session review: USD/JPY significantly lower

The New Zealand dollar rose in the second half of the trading session on positive data on consumer confidence, house prices and state budget of New Zealand. Today, New Zealand's Finance Minister Bill English shown a substantial positive balance of the state budget for the fiscal year that ended on 30 June. The surplus of the state budget was 1.8 billion New Zealand dollars against 414 million New Zealand dollars in the previous fiscal year.

Data on consumer confidence have also been positive. The consumer confidence index calculated by ANZ-Roy Morgan, in October, rose to 122.9 from 121.0 in September and peaked from mid-2015.

The US dollar lost positions previously won against the yen dropping to intraday low of Y103,55 after rising to Y104,65. Yesterday USD / JPY rose in the anticipation of the September Fed meeting minutes. At the meeting, held on 20 and 21 September, the US Federal Reserve leaders laid the groundwork for a fairly early increase in interest rates. However, the views of Fed officials are divided on the timing of the next rate hike.

Some participants considered that it would be useful in the near future to increase the target range for interest rates on federal funds, if the situation on the labor market continues to improve, as economic activity strengthens. Others would wait for a more convincing evidence that inflation moves towards the target level of the Fed, which is 2%.

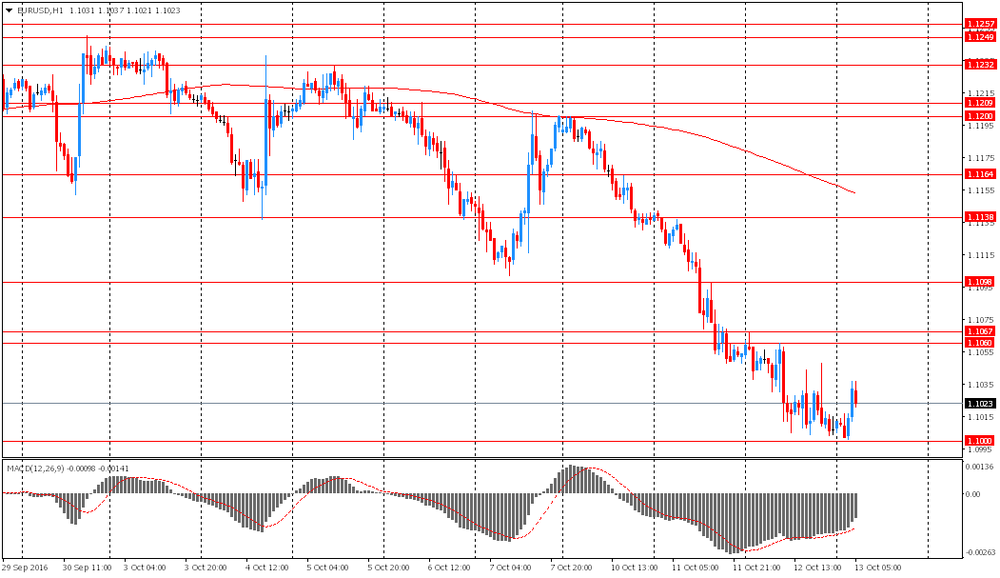

EUR / USD: during the Asian session, the pair was trading in the $ 1.1000-35 range

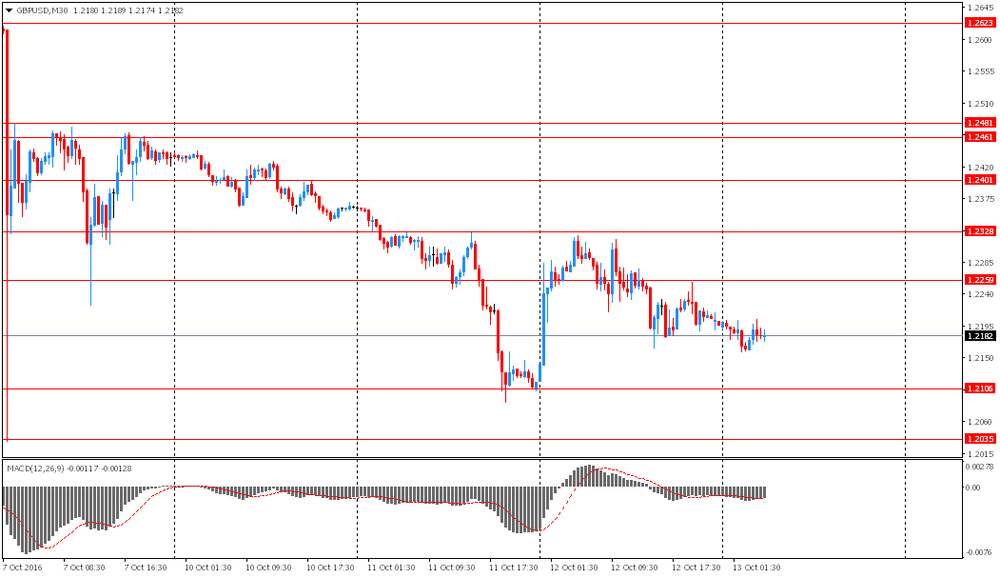

GBP / USD: during the Asian session, the pair was trading in the $ 1.2155-00 range

USD / JPY: declined 100 pips to 103.52

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.