- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Asian session review: The New Zealand dollar rose

Asian session review: The New Zealand dollar rose

The New Zealand dollar rose against the background of a rise in price of milk powder. At the end of the GlobalDairyTrade auction prices for dairy products rose by 1.4% compared with the auction two weeks ago. These price increases have not lived up to expectations, but due to the limited supply of dry milk demand will continue to be enhanced, according to the market. Milk is the largest section of New Zealand's exports. For the current year milk powder prices rose by 25% and is projected to continue to grow, said Elias Haddad of the Commonwealth Bank of Australia. Also, the New Zealand dollar was supported by the inflation data for the 3rd quarter, which turned out to be stronger than expected, which reduced the probability of a rate cut.

The euro rose slightly against the US dollar. Experts attribute this to the recent disappointing US data and the Fed's controversial comments regarding the rates. Futures on interest rates pointed to 69.1% probability of a rate hike in December, against a 50% probability in the middle of last month.

The Australian dollar has risen since the beginning of the session, but then lost positions on the background of ambiguous Chinese economic data. Gross domestic product, published by the National Bureau of Statistics of China, rose 1.8% in the third quarter, while in annual terms by 6.7%, in line with economists' forecast and the previous value. According to the report, the economy remained at the level of the previous quarter, indicating that the ongoing efforts to stimulate the economy by the government contribute to stabilization. "China's economy continues to grow steadily, we are optimistic about its prospects", - the official representative of the State Statistical Office said today.

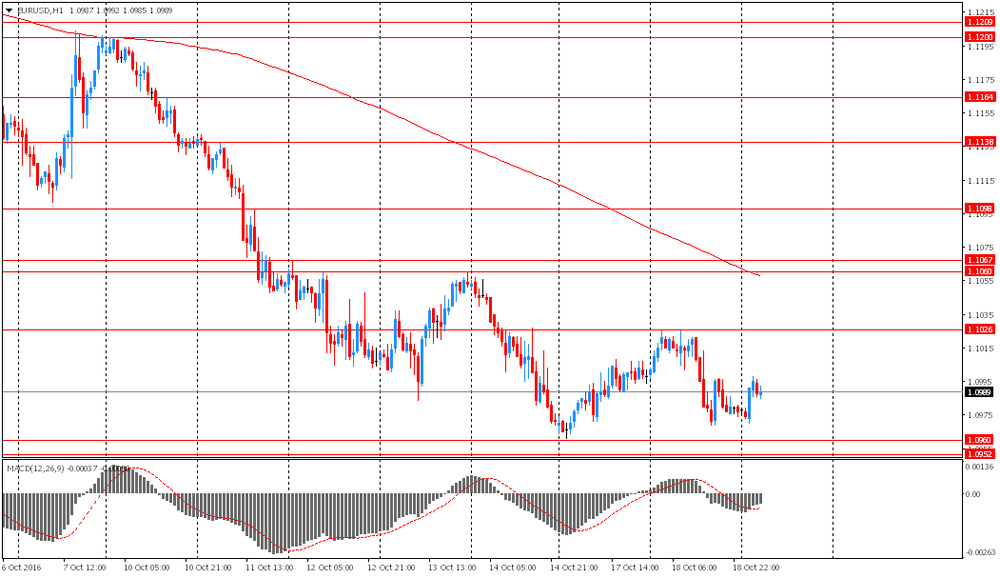

EUR / USD: during the Asian session, the pair rose to $ 1.0995

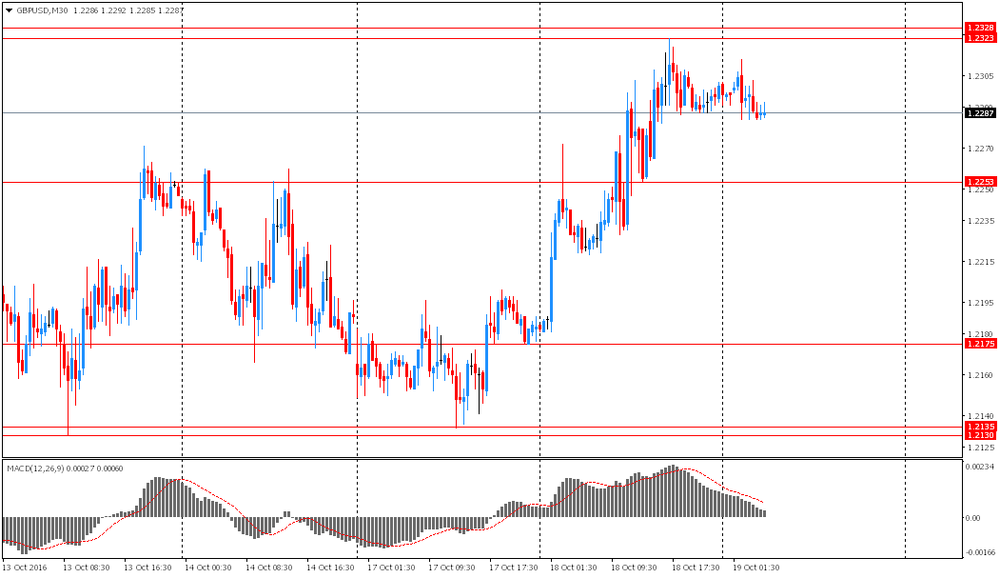

GBP / USD: during the Asian session the pair fell to $ 1.2270

USD / JPY: fell to Y103.65

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.