- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Asian session review: The euro fell continuing yesterday's decline

Asian session review: The euro fell continuing yesterday's decline

The euro fell, extending yesterday's decline after the ECB meeting. ECB left its key rate unchanged at a record low of 0%, which corresponded to the expectations. Central Bank President Mario Draghi at the press conference signaled that the bond purchase program may be continued after March 2017, but has not announced a clear intention to do so.

The US dollar rose against major currencies amid growing investor confidence in a Fed hike. According to experts, the strong economic data and comments by Fed officials support the expectations of higher interest rates in December. On Wednesday evening, William Dudley said that the central bank may be able to raise interest rates by year end. Earlier this week, the same comments made by the Vice-Chairman Stanley Fischer. According to Fed funds futures the probability of a hike in December is 74% vs 69.5% earlier this week.

Also today, Haruhiko Kuroda said that the central bank may temper the optimistic forecasts next year. This indicates a continuous struggle to complete a deflationary cycle. "We are already in the middle of the fiscal year, but inflation is still in negative territory," - said Kuroda in the Parliament when discussing consumer prices, taking into account energy. According to him, the central bank may revise its forecast that core inflation will reach 2% in 2017 fiscal year.

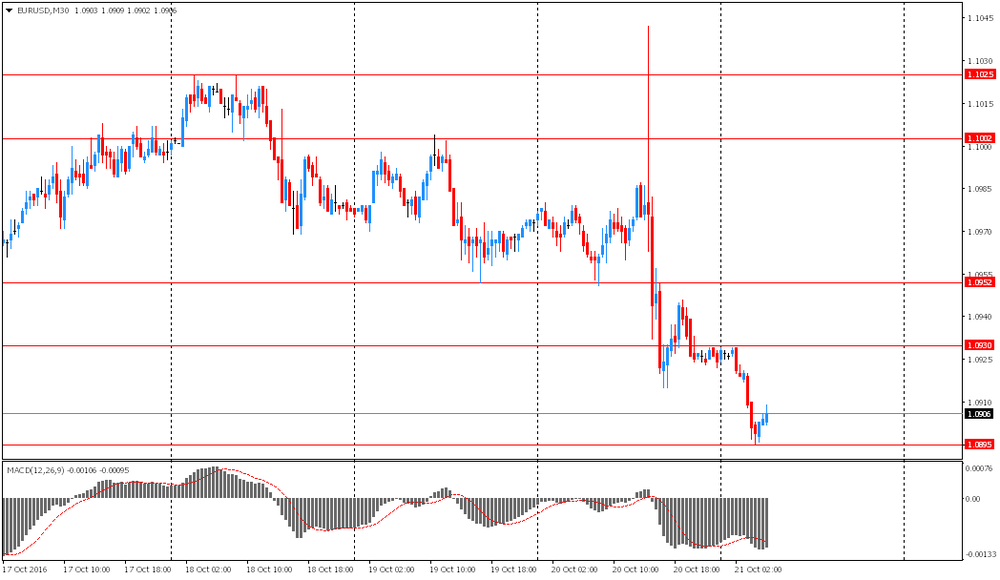

EUR / USD: during the Asian session the pair fell to $ 1.0895

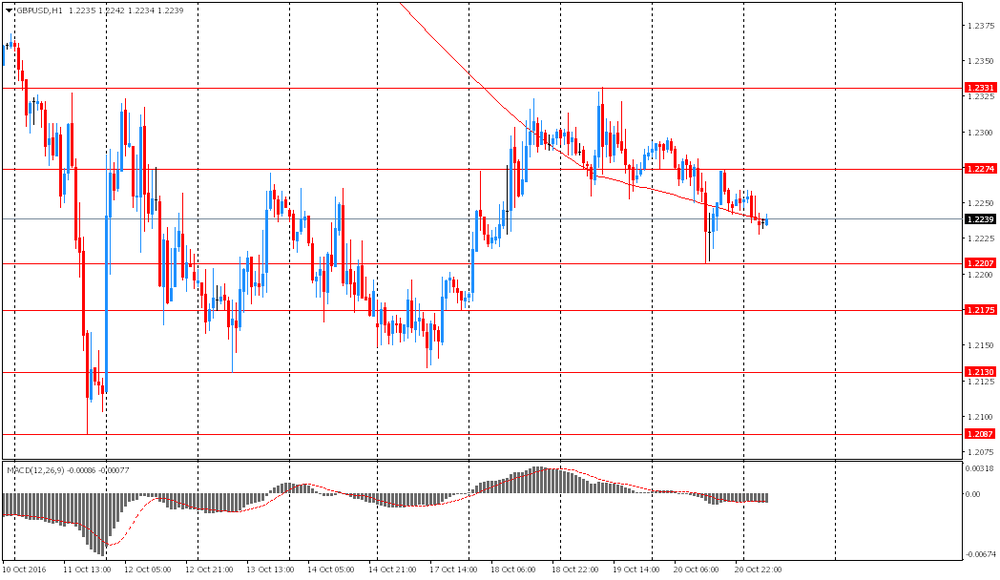

GBP / USD: during the Asian session the pair fell to $ 1.2225

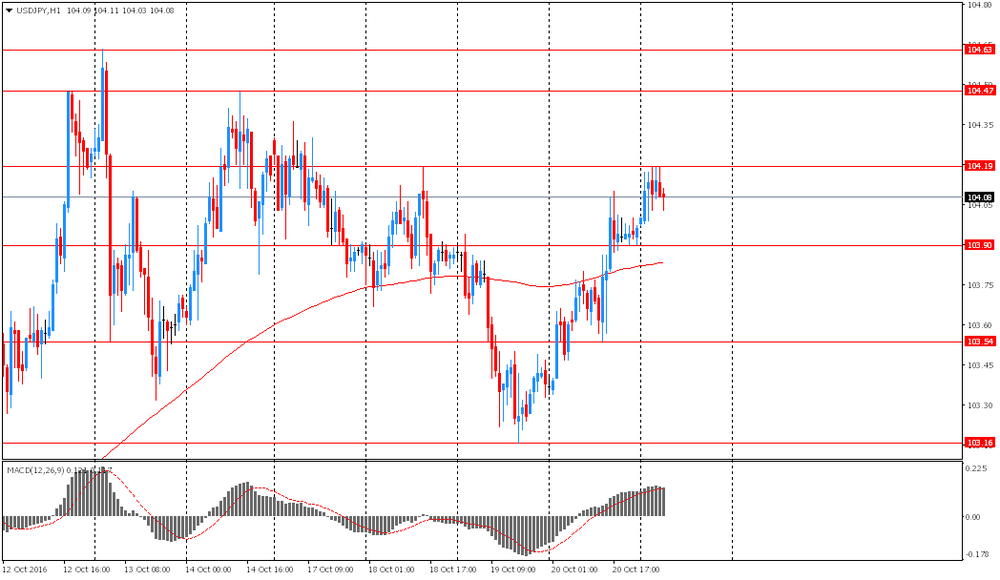

USD / JPY: during the Asian session, the pair rose to Y104.20

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.