- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Societe Generale’s case for EUR/GBP long

Societe Generale’s case for EUR/GBP long

"How do we profit from a period of EUR/USD drifting lower in its current range as US Treasury yields edge higher, before possibly rising sharply at some point in the next six months, which is impossible to see with any precision?

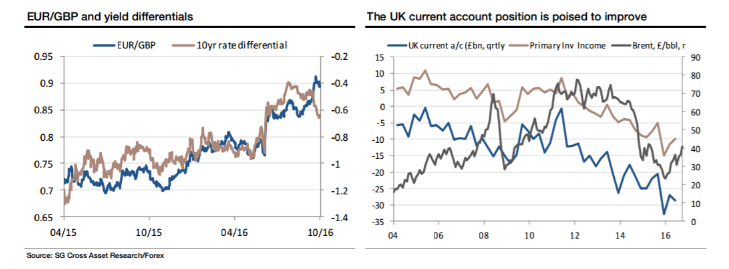

In spot, our preference is to take advantage of EUR/USD softness to buy EUR/GBP. The risk now is a broader loss of confidence in UK assets amidst political and economic uncertainty that would hurt UK bonds, currency and equities at the same time. That would send EUR/GBP up almost as much as GBP/USD fell.

Two big tail risks, for GBP down and EUR up, can make for a large move in EUR/GBP*. The danger is that now that we have seen the big adjustment in the pound, what we get from here is a tight range with low volatility, but for a directional trade, EUR/GBP looks to have a very big upward skew in the possible outcomes.

It's only fair to point out that one threat to the UK that shouldn't be overstated is the dire state of the balance of payments. Yes, the UK current account deficit is running at a quarterly rate of over £30bn, but it will soon improve. The vast bulk of the deterioration, shown in the chart below, comes from primary investment income, which mostly means the balance of income UK companies earn abroad relative to what foreign companies earn in the UK. A weak pound should help correct this, but so should higher oil and commodity prices. A strong pound and soft commodity prices really hit the overseas earnings of big UK-based resource companies, but the sterling price of oil is bouncing fast. This is worth watching, particularly when the 4Q and 1Q current account data are released next year".

SocGen maintains a long EUR/GBP position from 0.8620 in its portfolio.

Copyright © 2016 Societe Generale, eFXnews™

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.