- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD Rally To Target EUR/USD At 1.05 & USD/JPY At 110 - Nomura

USD Rally To Target EUR/USD At 1.05 & USD/JPY At 110 - Nomura

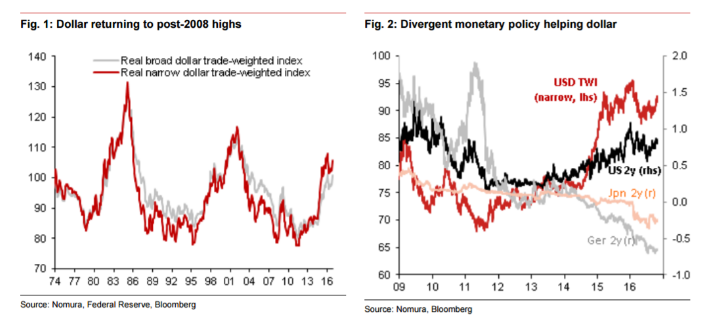

"At last, a dollar trend appears to be developing. This month, the dollar has rallied against almost all currencies including emerging market ones. The broad trade-weighted dollar is close to its post-2008 highs last seen at the turn of the year.

Undoubtedly what has helped is a monetary policy divergence story between the Fed and its peers...One factor that could further bolster the dollar would be a Clinton victory, not least because it would bring about continuity in economic arrangements between the US and the rest of the world.

As for currency pair specific dynamics, we find that euro-area investor repatriation flows, especially in equities, appear to be coming to end, while bond outflows continue. This dynamic has been a stubborn support for the euro for much of the past year, but is unlikely to be so in the future. On the yen, we expect Japanese institutions to reduce their hedge ratios as hedging costs are higher than before. There are also more signs that Japanese investors are buying foreign equities. A less-discussed factor is the decline in Chinese buying of Japanese assets, which may well have been part of a reserve rebalancing programme earlier in the year. It likely helped yen strength over that period, but as with euro repatriation, this flow will not be forthcoming.

Consequently, there is scope for dollar strength to lead to the euro heading to its 2015 lows of 1.05 and USD/JPY rising to 110 - its level before the market gave up on the Fed in June".

Copyright © 2016 Nomura, eFXnews™

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.