- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- WSE: Session Results

WSE: Session Results

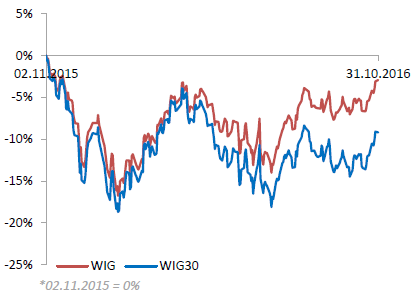

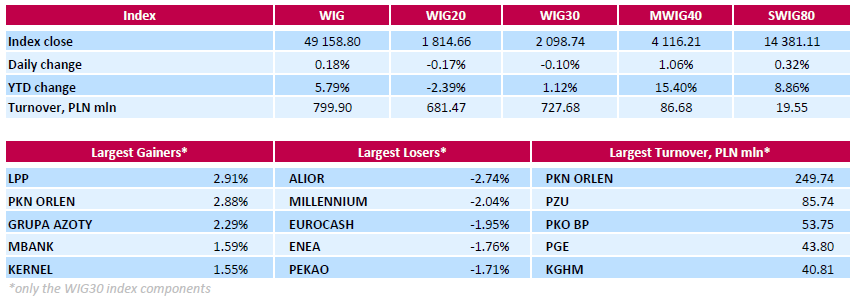

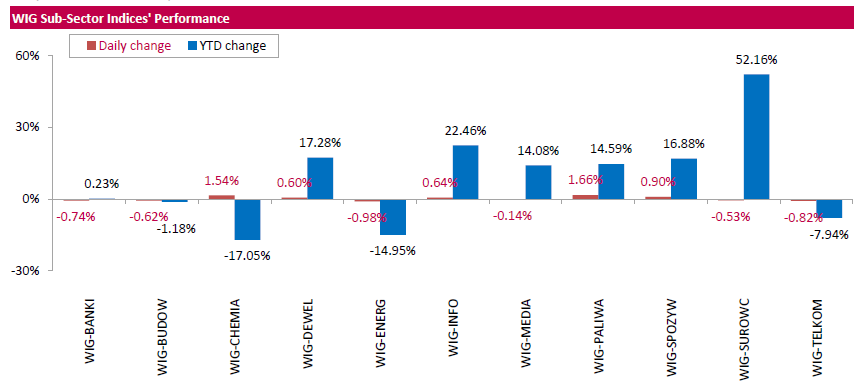

Polish equity market closed slightly higher on Monday. The broad market measure, the WIG Index, added 1.18%. Sector performance within the WIG Index was mixed. Oil and gas sector (+1.66%) outperformed, while utilities (-0.98%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, slipped 0.1%. Within the index components, clothing retailer LPP (WSE: LPP) led the gainers, jumping by 2.91%. It was followed by oil refiner PKN ORLEN (WSE: PKN), gaining 2.88%, supported by an analyst price target increase. Other major advancers were bank MBANK (WSE: MBK), agricultural producer KERNEL (WSE: KER) and two chemical producers GRUPA AZOTY (WSE: ATT) and SYNTHOS (WSE: SNS), growing between 1.5% and 2.29%. At the same time, the session's largest losers were FMCG-wholesaler EUROCASH (WSE: EUR) and two banking sector names ALIOR (WSE: ALR) and MILLENNIUM (WSE: MIL), losing between 1.95% and 2.74%. Utilities names ENEA (WSE: ENA), ENERGA (WSE: ENG) and PGE (WSE: PGE) were also beaten down heavily (the stocks tumble by 1.25%-1.76%), as the Poland's Energy Minister Krzystof Tchorzewski stated it was a mistake that country listed its state-run electric utilities, adding the main goal of these companies is providing energy security to Poland and not generating profits.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.