- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- BofA Merrill buying USD/JPY dips

BofA Merrill buying USD/JPY dips

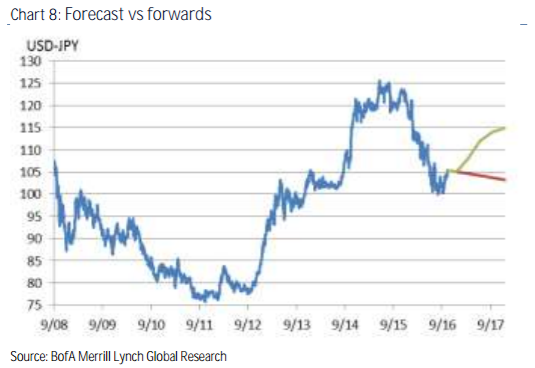

"Themes: JPY bulls won on the BoJ One-week implied volatility for the USD/JPY options market stands below 10, the lowest level ahead of a BoJ meeting all year. In our view, this reflects not only declining overall market volatility, but also strengthened policy sustainability since a new policy framework was introduced in September as well as recent remarks by BoJ Governor Haruhiko Kuroda indicating any major policy changes are unlikely anytime soon. Moreover, the BoJ's seemingly new communications strategy-shifting from delivering surprises to guiding expectations-will help avoid unnecessary rise in volatility. As long as the JGB curve remains stable, currency traders' incentive to trade on the BoJ's policy meetings will probably subside for some time.

The US presidential election will be the key driver of USDJPY over the short term as the election outcome will have quite binary implications on JPY. If the Republicans win the presidential race, JPY is likely to rally significantly short term amid risk-off trading. If the Democrats win, the market reaction is likely to be limited as it has been largely priced in. Gridlock in the congress would have negative implications on USD while a clean sweep - one party winning the presidential seat and congress - by either party would support the currency.

That said, we believe the case for the yen's depreciation into 2017 is strong so that we would be buyers of USD/JPY's dip rather than sellers of USD/JPY's strength.

Forecasts: JPY to weaken in 2017 .We have kept our view that 100 is where USD/JPY's long-term risk reward starts shifting upward. While the US elections pose near-term risk, we believe USD/JPY is likely to rise to 115-120 by end 2017".

Copyright © 2016 BofAML, eFXnews™

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.