- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD/JPY: targets for US Elections outcomes - NAB

USD/JPY: targets for US Elections outcomes - NAB

"The near term direction in USD/JPY is at a cross road.

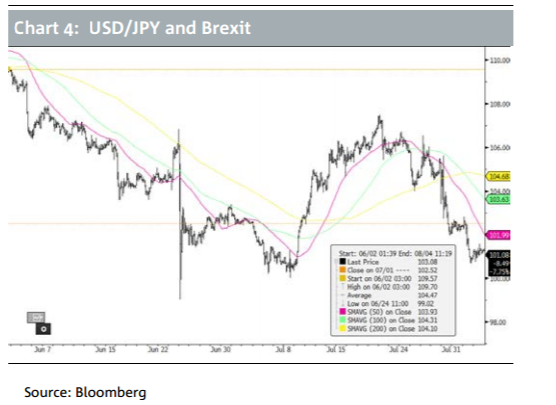

A Trump win (not our base case scenario) would put Fed hikes on the back burner and trigger a flight to safety with the JPY one of the biggest beneficiaries. This year USD/JPY has found solid support around the ¥100 mark, however under such scenario it will easily slice through this barrier. The surprise Brexit outcome saw USD/JPY trade from an intraday high of ¥106.84 to a low of ¥99.02 with the currency eventually settling 4 big figures lower relative to its previous day's close.

On a Trump victory, long term chart dynamics and recent price action suggest to us USD/JPY would likely settle around the ¥97/98 mark with an intraday low potentially a few big figures lower. Currency intervention under this scenario is also a consideration. Ahead of Brexit, Finance Minister Taro Aso warned that Japan was ready to intervene to prevent excessive yen strength, but in the event and despite the volatility and sharp currency appreciation on the day, there was no intervention. An excessive Yen appreciation will no doubt hinder Japan's already anaemic economic recovery, however unless we see a move closer to the low ¥90s, we think the MoF and BoJ will painfully sit on the sidelines.

Ten days ago - prior to the news of a fresh FBI/email probe, a Clinton win would have hauled up risk assets, sealed the deal for a December Fed hike, pushed 10y US Treasuries towards 2% and lifted USD/JPY comfortably above the ¥107 mark. With investigations into Clinton's legal affairs closed once more, then for now at least this scenario again looks conceivable".

Copyright © 2016 NAB, eFXnews™

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.