- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD/JPY Towards 112 Initial Target; EUR/USD: 1.07 Key Now - Morgan Stanley

USD/JPY Towards 112 Initial Target; EUR/USD: 1.07 Key Now - Morgan Stanley

"USDJPY support from all sides:

Crossing through a previous high at 107.49, we foresee an initial target of 112. We have often said that higher inflation expectations or steeper yield curves would have been required for USDJPY to turn around. However, the reason for steepening didn't need to come from the Japanese side. The correlation between global bond markets is high, meaning the US 2s10s curve hitting the highest level this year has spilled over into the Japanese curve steepening too. Steepness has been focused on the shorter end of the curve (<10y) as the BoJ's QE purchases are likely to be largest here, adding to JPY weakness.

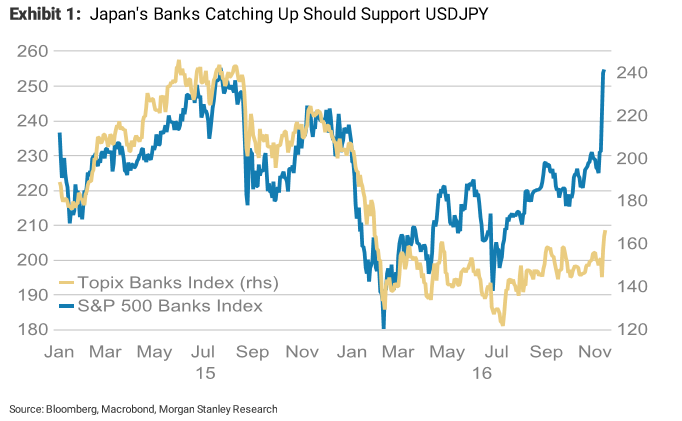

The Exhibit below shows that Japan's TOPIX banks index still doesn't reflect this new curve dynamic and has been underperforming US banks. Japan's 3Q GDP beating market expectations, rising by 0.5%Q (0.2%Q expected) due to stronger net exports, suggests that a recovery is under way here, which counterintuitively is negative for the currency as more capital is exported abroad. Japan's 10y real yield falling from -0.28% for -0.47% today while US real yields rise has supported USDJPY too.

EURUSD downside limited:

As the market prices in a faster pace of Fed hikes due to expectations of higher growth and inflation, there could also be debates forming about whether the ECB will need to extend its QE programme beyond next year. The US 5y5y inflation swap has hit the highest level this year at 2.47%, allowing the eurozone's equivalent measure to also rise to 1.55%. We expect EURUSD to find support around 1.07.

The real yield differential between the eurozone and the US remains relatively supported, which we think should limit outflows from the eurozone".

Copyright © 2016 Morgan Stanley, eFXnews

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.