- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- ANZ targets EUR/USD at 1.07 at year end. Some reasons for caution on shorts

ANZ targets EUR/USD at 1.07 at year end. Some reasons for caution on shorts

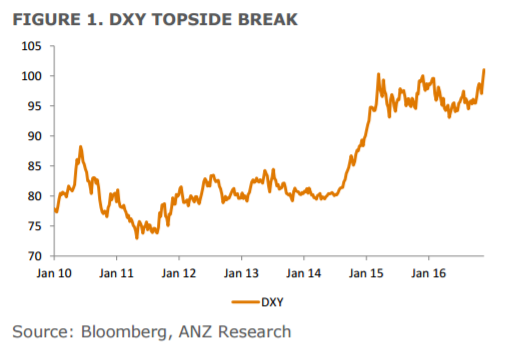

"The dollar's appreciating trend has intensified as the anticipated policy dynamics of an expansionary fiscal stance and higher interest rates under a Trump presidency have proved to be a powerful dynamic for the currency. DXY is now at its strongest level since Q1 2003 and market expectations are growing that the dollar may rise materially further over the medium term as fiscal expansion is overlaid on an economy operating at or very close to full employment. The sharp rise in bond yields has also assisted dollar strength.

That said, we are cautious about getting caught up in the whirlwind and revising up our dollar forecasts higher just now based on anticipated US economic policy.

We anticipated a move into a 1.00-1.05 range for EUR/USD next year, as whoever was elected president would pursue a more expansionary agenda. That view still remains the case and there are a number of reasons why we are hesitant to revise up our forecasts.

Based on the DXY, the dollar is at its highest level since 2003. But it is interesting that in 2003 the dollar was in a pronounced depreciation phase amid (then) President Bush's policy agenda of steel tariffs (2002) and tax cuts, whilst inflation was also rising. Currently, US inflation is rising and the US Presidentelect's indicated policy priorities of renegotiating trade arrangements, threatening higher tariffs, and cutting taxes is having exactly the opposite effect on the USD. At present, various PPP estimates, ranging from producer prices to the Big Mac index, imply the euro is around 20% undervalued versus USD.

For now though, the expectation that an expansionary fiscal policy will come when the economy is operating at full employment should continue to lend support to the USD. Barring some shock, the FOMC should announce a 25bps rate rise in the fed funds target on 14 December whilst the ECB is expected to extend its QE program when it meets on 8 December. There is also the potential for a rise in uncertainty should the referendum in Italy fail on 4 December, not to mention elections in the Netherlands, France, and Germany next year. The European dimension is an important element in our expectation of further dollar gains in the coming months and that could deteriorate further. Would an additional 5-10% political risk premium be required if the European political environment deteriorates in the near term? Probably, but as opinion polls have shown this year, forecasting political outturns is very difficult. With that in mind and given the direction of travel in policy divergence, we continue to maintain a bullish disposition towards the USD vs EUR".

ANZ targets EUR/USD at 1.07, 1.06, and at 1.04 by the end of Q4 '16, Q1 '17, and Q2 '17 respectively.

Copyright © 2016 ANZ, eFXnews™

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.