- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Whats the dollar trade? - Goldman Sachs

Whats the dollar trade? - Goldman Sachs

"In our last FX Views, we argued that the US election represents a "reset" for two reasons.

First, the possibility of meaningful fiscal stimulus in an economy where slack is close to zero raises upward pressure on inflation, as Chair Yellen and NY Fed President Dudley acknowledged this week.

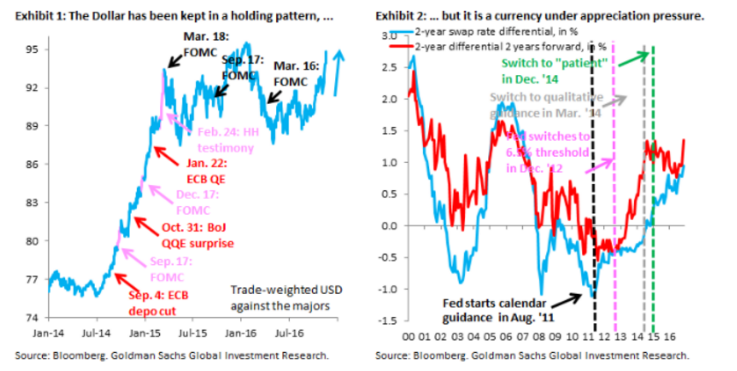

Second, President-elect Trump can make a number of appointments to the Fed in fairly short order, which could shift the reaction function hawkish. Both things have pushed front-end interest rates up (Exhibit 2), and the Dollar is now near the top of the range it has traded in since March 2015.

As in 2014, when the Dollar was on the move, the question is now how much further it can go in the near term. Federal funds futures are one lens through which to look at this. They have obviously moved a lot, but the market in our view is still catching up to the changed landscape. The market is pricing 64 bps in tightening through 2017, well below our US team's forecast of 100 bps. More importantly, through end-2019 the market is pricing 130 bps, or just over five hikes.This strikes us as low and points to further upside for the Dollar, including in the near term.

We are through our year-end targets for EUR/$ (1.08) and $/JPY (108), which were controversial just a short time ago, and the risk to our 12-month forecasts - 1.00 for EUR/$ and 115 for $/JPY - is now firmly in the direction of more Dollar strength.

Sterling downside has fallen out of favor, but we think remains one of the most actionable themes. This is why we went short Sterling and the Euro against the Dollar as one of our Top Trades for 2017.

...By choosing to also include EUR on the short leg of the trade, we are essentially taking an agnostic view with regard to EUR/GBP. Indeed, our new EUR/GBP forecast is 0.90, 0.88 and 0.88 in 3-, 6- and 12-months. The slew of elections slated to take place across Europe this year present a number of catalysts for the trade, and we have kept our call for EUR/USD parity on a 12-month horizon unchanged. Given that the ECB is so far from its inflation target, it should not respond to any rising inflationary pressures in the same way as the Fed, although premature tapering from the ECB is a risk to the trade".

Copyright © 2016 Goldman Sachs, eFXnews™

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.