- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EUR/USD ahead of NFP and Italian Referendum - Barclays

EUR/USD ahead of NFP and Italian Referendum - Barclays

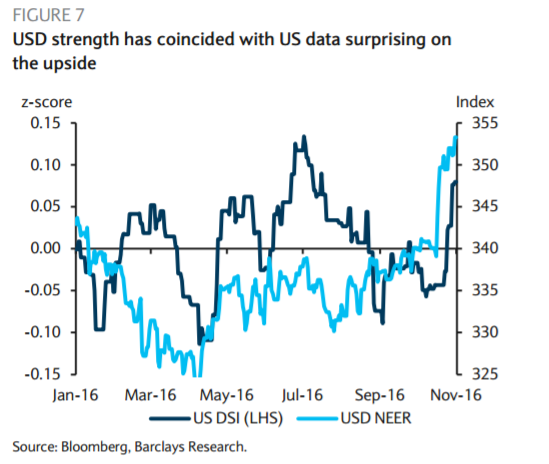

"We see asymmetric risks to the USD this week as the employment report (Friday) takes central stage. A number close to our expectation of 175k or even lower would keep the Fed on track as it is assumed that a deceleration in job creation is normal as the labour market is near full employment. On the other hand, a higher number (closer to 200k) would signal that the momentum is still strong, and that additional stimulus would probably lead the Fed to act faster, accelerating USD trend. We expect the unemployment rate to decline to 4.8% from 4.9%, average hourly earnings to rise 0.2% m/m and 2.8% y/y, and the average workweek to remain unchanged at 34.4 hours.

In addition, we expect the ISM manufacturing (Thursday) to remain soft and decreasing slightly from 51.9 to 51.5 as employment in the manufacturing sector remained weak through October.

Next Sunday's Italian referendum on Senate reform is an important event for markets this week but a "no" outcome appears largely priced in EURUSD, in our view. Polls suggest that most voters oppose PM Renzi's proposal and should that be realised, we expect him to step down. While recent EURUSD depreciation has largely been driven by USD strength, we think a portion of recent EUR weakness reflects a discount to various political risks over the coming year, including elections in the Netherlands, France and Germany. Given these residual risks we think any sustained EURUSD appreciation is unlikely. The reaction to a surprise "yes" vote is uncertain with, bi-modal implications: it simultaneously increases the likelihood of Prime Minister Renzi's reform agenda (if the PD, Mr. Renzi's party, wins the next election) and the likelihood of radical change and rejection of the euro if 5SM wins.

On the data front, November euro area headline/core inflation (Wednesday) is expected to remain unchanged at 0.5%/0.8%, while euro area final November manufacturing PMI (Thursday) is expected to be confirmed at 53.7".

Copyright © 2016 Barclays Capital, eFXnews™

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.