- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Barclays has 3 reasons for sharper near-term USD upside risks

Barclays has 3 reasons for sharper near-term USD upside risks

"Last week's FOMC meeting was more eventful than what we and the market were expecting. We read subtle hawkish signals regarding the outlook of monetary policy, therefore tilting risks for the USD toward a sharper appreciation in the months to come (see USD upside risks), against our expectations of USD consolidation

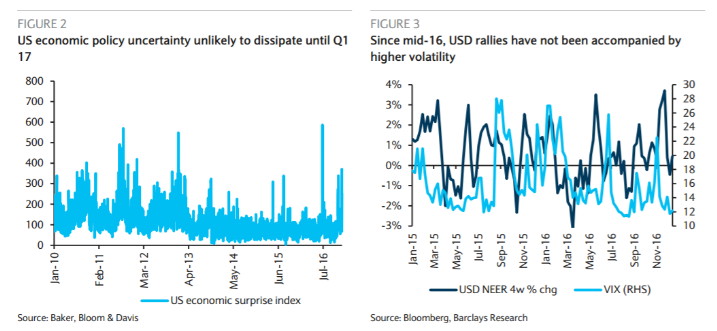

First, because any potential fiscal boost from the Trump administration is still very uncertain (Figure 2), it has yet to be incorporated into the FOMC's economic outlook, as only "some" members included it in their projections. Therefore, we see further room for the market to price in a steeper path for the fed funds rate in 2017, as fed funds futures are pricing only 55bp of hikes in the year to come.

Second, the FOMC seems less concerned about the effect of a higher USD and rates. Unlike previous episodes, the USD recent uptrend has not been accompanied by higher volatility or a sharp move lower in commodity prices (Figure 3), something that had constrained the Fed before from accelerating its normalization pace. It looks like Chair Yellen now sees the re-pricing in US assets as consistent with the improvement in the job, growth and inflation outlook stemming from the market's implicitly pricing a more expansionary fiscal policy.

Third, the appetite for running a "high pressure" economy to boost productivity growth at this point of the business cycle is diminishing. Although Chair Yellen emphasized the fact that the revision in the median projection of the 2017 dots, employment and growth outlook was very moderate, she did not stress as much as in the past the fact that the normalization process should be gradual".

Copyright © 2016 Barclays Capital, eFXnews™

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.