- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Danske says EUR/USD set to bottom around 1.02 in 1-Month

Danske says EUR/USD set to bottom around 1.02 in 1-Month

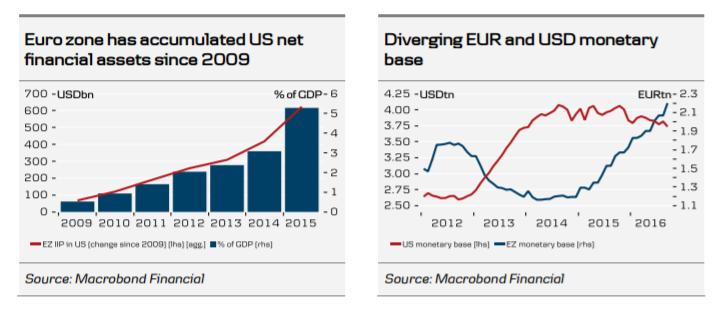

"Short term (1-3M horizon): In the short term, on the one hand there will be downward pressure on the US monetary base from the higher federal funds target and from the impact of new banking regulation with US banks set to be required to have an LCR of 100% by 1 January 2017. On the other hand, deposits on the US treasury account may fall at the beginning of next year after a resuspension of the debt ceiling, which will tend to increase the monetary base. Overall, this is likely to be marginally positive for USD and weigh on USD FX forward points vis- à-vis EUR and the Scandinavian currencies on top of the impact of the repricing of the path of Federal Reserve rate hikes, e.g. keeping the 3M EUR/USD basis spread around the present 70-80bp, and thus maintaining a significant negative carry on short USD positions. We look for EUR/USD to bottom at 1.02 in 1M.

Medium-term (6-12M horizon): Implementation of new regulation will continue in 2017, which is likely to continue to put downward pressure on the US monetary base. Additional rate hikes from the Federal Reserve in 2017 (we forecast a 25bp hike in June and December) are likely to be less of a strain on the monetary base than before and after the rate hike in December 2015, as the hiking cycle seems better aligned now with a recovery in the natural rate of interest. If the Federal Reserve attempts to push rates higher at a faster pace, it may become an issue though. This will maintain a higher negative carry on short USD positions vis-à-vis EUR and Scandinavian currencies than can be explained by the spread in interest rates, e.g. the 3M EUR/USD basis spread should stay around the present 70-80bp. Over the medium term, we look for the USD to fall back on valuation and the beginning of a correction of the large US current account deficit. As implementation of new regulation moves closer to the end, it should furthermore be less of a supportive factor for the USD. We forecast that EUR/USD will rise to 1.12 on 12M".

Copyright © 2016 Danske, eFXnews™

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.