- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EUR - Cheap but unbuyable yet, JPY too fast to sell - Societe Generale

EUR - Cheap but unbuyable yet, JPY too fast to sell - Societe Generale

"A look forwards. The yen's nearly fallen too far/too fast to sell, the dollar's getting closer to its peak and the Euro is cheap but unbuyable before the French elections.

My favourite currencies are Scandinavian, and after an unstellar 2016, long SEK/KRW is a trade we've been pushing for a week or two. A more mundane G10 version is short EUR/SEK. A second trade is to be short NZD/NOK. Long current account surplus, short deficit. Finally, with all this positive growth, oil isn't done yet. Short GBP/CAD for a final flurry..

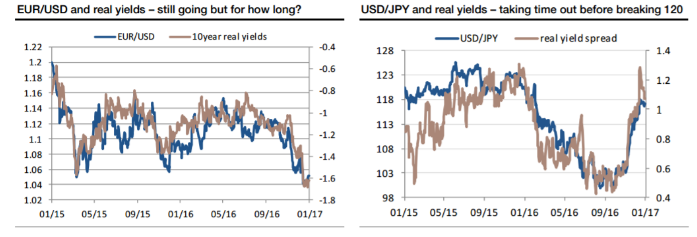

There is no Eurodollar recommendation on the list, though we do expect to see parity before the French presidential elections. In nominal terms, the Treasury/Bund yields spread, at around 225bp, is wider than any any point since April 1989, the time of the Hillsborough disaster and just over 6 months before the Berlin wall came down. More recently, we've seen a 100bp widening in the real yield differential between Germany and the US since the start of 2015, which has taken EUR/USD down by 15 figures. Another 30bp real yield widening isn't impossible but this morning's release of the strongest Eurozone manufacturing PMI since 2011 is surely a reminder that a softer currency and stronger US data aren't really compatible with never-ending doom pessimism about the European economic outlook. Getting EUR/USD down is like pushing Sisyphus' rock uphill.

USD/JPY doesn't look like an exciting buy on real yield differentials now, but they should be supportive again going forwards. Tread carefully, yen bears!"

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.