- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- 'Uncertain' mentioned 15 times in December FOMC minutes vs 5 times In Nov - Danske. Trumponomics in focus

'Uncertain' mentioned 15 times in December FOMC minutes vs 5 times In Nov - Danske. Trumponomics in focus

"The FOMC members think the economic outlook is very 'uncertain' until we get more information about 'Trumponomics'. The word 'uncertain' is mentioned 15 times versus five times in the minutes from the November meeting.

The FOMC members think 'growth might turn out to be faster or slower than they currently anticipated' depending on the policy mix (tougher immigration rules and more protectionism slow growth while infrastructure spending and tax cuts increase growth). 'Almost all' FOMC members think there are upside risks to their growth forecasts due to the likely fiscal boost, which they have not fully taken into account.

Given the Fed's focus on 'Trumponomics', any comments or tweets from Donald Trump on economic policy will be followed closely.

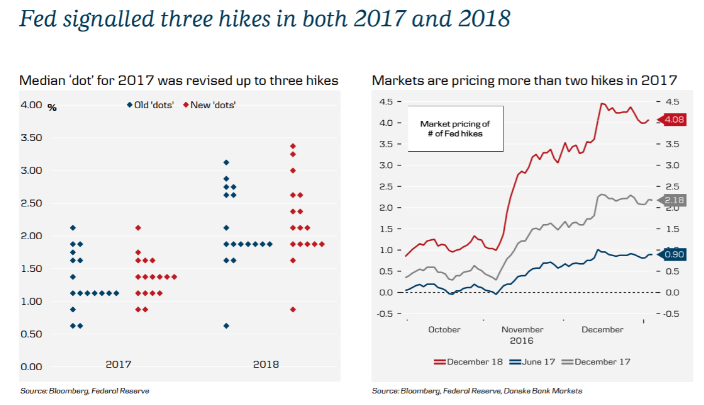

We stick to our view that the Fed will hike twice this year (June and December) but believe the risk is skewed towards three hikes. One of the reasons is that the Fed has turned more dovish this year due to shifting voting rights, which mean that we (for now) weight dovish comments more relative to hawkish comments. This year we learned that it does not take much for the (dovish) FOMC members to postpone a hike.

That said, we believe the Fed is likely to increase its hiking pace in 2018 (late 2017 at the earliest), as we think Trump's fiscal policy is likely to have the biggest growth impact in 2018 due to policy lags (see also Five Macro Themes for 2017, 1 December 2016), although much can obviously still happen before 2018".

Copyright © 2017 Danske, eFXnews™

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.