- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Societe Generale asking when the USD will peak

Societe Generale asking when the USD will peak

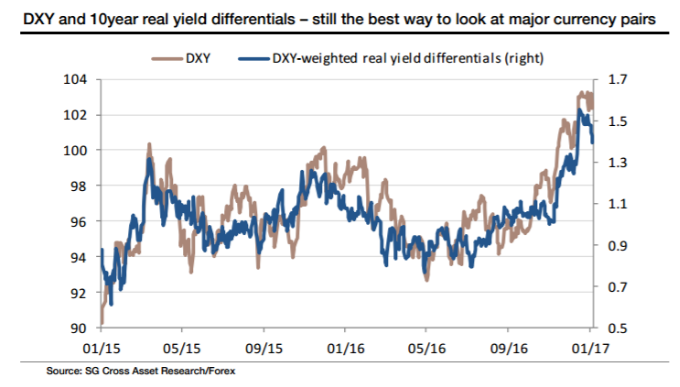

"Over the last few years, the relationship between FX rates and interest rate differentials has shifted. The chart below shows DXY-weighted 10year real yield differentials next to the DXY index. Not perfect, but not bad. This fit is better than for 10year nominal yields, and better than for 10 or 2 year swap differentials for that matter and for now, it's going to remain a corner-stone of how we think about FX trends in 2016. This relationship is interesting and useful but of course, it largely swaps one problem - trying to forecast FX trends by looking at the wrong things - while creating another - trying to forecast trends in real yield

As for timing on a dollar peak, our best guess is 99 days of President Trump's inauguration. That's absurdly precise but markets have embraced the idea that the new president is good for business confidence and will be good for the economy through policies that reduce taxation, increase spending, and reduce regulation. By the time his first hundred days are over, we might well be in a state of sever over-excitement. 99 days after inauguration takes us to 29 April, the day before the first round Presidential vote in France.

We're pencilling in parity for the EUR/USD and the year's widest level for relative real yields for that period too".

Copyright © 2017 Societe Generale, eFXnews™

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.