- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Credit Agricole is long USD/CAD. Where to target

Credit Agricole is long USD/CAD. Where to target

"The CAD has recouped its post-BoC losses. Markets were probably encouraged by President Trump's approval of the Keystone XL oil pipeline, previously blocked by President Barack Obama on environmental concerns.

However, we do not see this as an immediate negative for USD/CAD: although this would facilitate the delivery of oil from Western Canada to US refineries in several years' time, the immediate impact will mostly be via increased US hiring during the construction of the project. Markets were also likely to have been encouraged by the relatively constructive tone from Prime Minister Justin Trudeau and other Canadian politicians with respect to potentially re-negotiating the NAFTA terms, suggesting that the close US-Canada trade relationship will most likely largely survive the protectionist leanings of the new US administration.

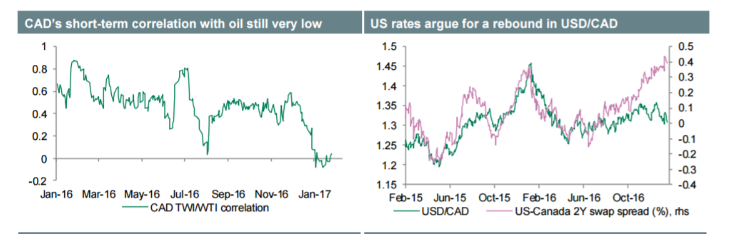

However, from a valuation perspective, the CAD is starting to look expensive again, as oil prices remain in their current USD51-55/bl range and 2Y rate differentials with the US continue to widen.

We expect USD/CAD to rise to 1.37 by the end of Q1 and 1.40 by Q3.

In the week ahead, we are watching the November GDP report. BoC Governor Stephen Poloz speaks on Tuesday, 31 January, when he gets a chance to clarify his comment at the press conference that a rate cut remains "on the table".

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.