- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD will head back higher - Danske

USD will head back higher - Danske

"Year-to-date, the Dow Jones is up 1.71%, US 10Y yields are up 8bp and EUR/USD is 1 1/2 figure higher. Uncertainty is extraordinarily high given the lack of clarity on US economic policy, the risks of EU fragmentation with the near-term UK-EU Brexit negotiations, and the Dutch and French elections. Markets are struggling to grasp the policy uncertainties as the range of possible outcomes is so diverse. Hence, markets are trading sideways awaiting new information. Still, some markets are trending with German 10Y yields reaching the highest level in a year and bank stocks continuing their march higher.

We expected that there would be a market vacuum during H1 given the lofty expectations following Trump's win and the challenge he will face to enact fast fiscal stimulus. But it has surprised us how quickly the market vacuum arrived. This can be explained by positioning as the market was very short 10Y UST futures and long US dollars (USD) from the beginning of the year. The market is impatient and as the new US administration seems to have trade as its #1 priority we are not any wiser on fiscal policy (see Chart 1). However, during Trump's first 100 days in office we should know more about the new US government's fiscal policy plans. The market is likely to be significantly less short UST futures and long USDs than a couple of weeks back.

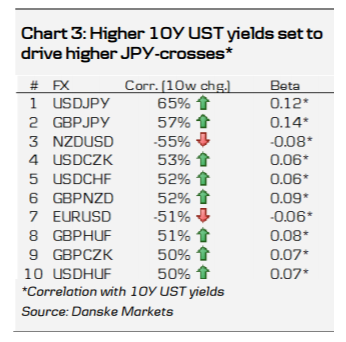

Where does this leave us in terms of markets? We see risks skewed towards higher US yields as positioning is probably cleaner now than a couple of weeks back and we will get more details on US fiscal stimulus plans during Trump's first 100 days in office. Due to the strong US economic data recently, we will look for signs in next week's FOMC statement on whether the next Fed rate hike could come as soon as March or May. Core European curves should continue to steepen from 5Y and beyond even though they are already at elevated levels (see Chart 2). A dovish ECB should help to reflate the European economy, driving longer-end yields higher.

Over the coming 1-3 months, we expect the USD to strengthen in line with the receipt of more detail on the new US government's fiscal stimulus plans and probably other tariff and tax measures during Trump's first 100 day in office. We expect JPY-crosses to be the worst hit by reflation, with the USD/JPY likely to head up towards mid-December highs of 118/119".

Copyright © 2017 Danske, eFXnews™

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.