- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Upside moves unlikely to be sustained on AUD/USD says BTMU

Upside moves unlikely to be sustained on AUD/USD says BTMU

"The broad retracement of US dollar strength in January reflecting increased protectionist steps by the Trump administration in the early stages of his presidency explains a good portion of the rebound in AUD/USD.

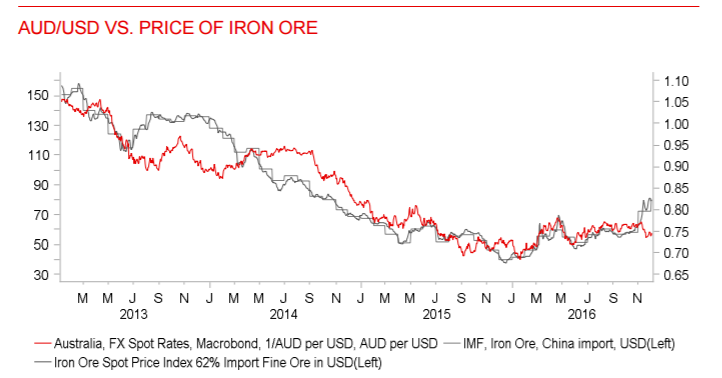

Optimism over improved global growth prospects have also been maintained which helps support the Australian dollar as well. That's evident by the price of iron ore, which closed January close to recent highs over USD 83 and close to 50% higher since October when the current rally began. But while the global picture currently is supportive for the Australian dollar, domestic factors are likely to continue weighing on AUD/USD.

The key event in January was the release of the Q4 inflation data that pointed to continued weak inflationary pressures that at the very least ensures a shift in monetary stance toward lifting rates remains a long way off. After four consecutive months of short-term yield increases, the weaker inflation resulted in a modest retracement in yields that points to limited upside for the Australian dollar from here.

Given our view that China growth is set to decelerate this year, we are also not expecting further notable advances in commodity prices generally. With the RBA side-lined and with the Fed set to raise rates at least on two occasions this year, we continue to expect offsetting forces (global reflation / policy divergence) to result in a relatively narrow trading range for AUD/USD implying that any notable moves, like that in January, are unlikely to be sustained".

Copyright © 2017 BTMU, eFXnews™

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.