- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- We are negative on the UK economy going forward although it did well in H2 last year. How to trade GBP/USD - SEB

We are negative on the UK economy going forward although it did well in H2 last year. How to trade GBP/USD - SEB

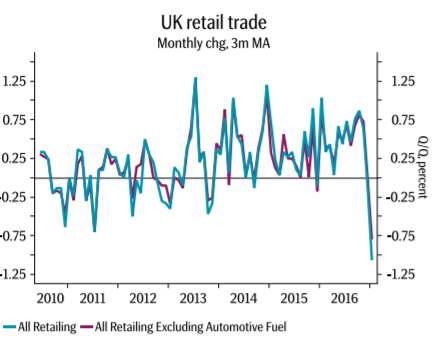

"We are negative on the UK economy going forward although it did well in H2 last year. In particular household and capital spending seem vulnerable from the impact of growing political uncertainty created by the upcoming divorce from the EU. Retail sales have already showed signs of slowing and will likely continue to do so.

However, these reasons for GBP weakness are currently overshadowed by political risks elsewhere, which have caused a small recovery of the GBP. We argue this recovery is just temporary and is unlikely to last.

Nevertheless, the net short exposure to GBP is still much larger than it has been historically. Consequently, sterling may well continue to recover in coming weeks as long as market players focus elsewhere. Not so much because things have improved in any particular way in the UK but more because political uncertainty and risks have increased elsewhere. This might well continue until the second round of the French presidential elections in May.

However, EUR/GBP around 0.83 would represent a compelling buy with a target closer to 0.90. Alternatively we suggest selling GBP/SEK around 11.50-11.70 for the currency pair to reach levels below 10.50 in the second half of this year".

Copyright © 2017 SEB, eFXnews™

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.