- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD risks also appear to be tilted to the upside, with the Trump administration still considering protectionist policies - CIBC

USD risks also appear to be tilted to the upside, with the Trump administration still considering protectionist policies - CIBC

"The US dollar's initial Trump bump has largely been sustained, but the President's first month in office hasn't seen any further gains on that front.

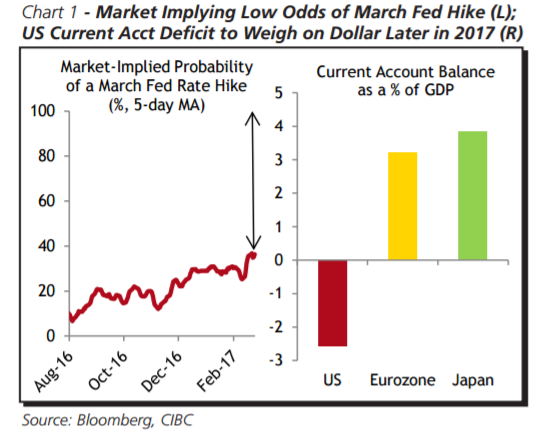

Attention has now shifted back to the central bank to give the greenback another boost, and while, on balance, Fed policymakers look like they have enough evidence to hike rates in March, the market is only assigning a 1 in 3 chance that they move at that meeting. Even if the Fed ends up passing on March, markets need to realize that another rate hike is coming soon, and that will push the US dollar stronger versus a variety of other currencies.

Risks also appear to be tilted to the upside, with the Trump administration still considering protectionist policies which could ultimately give greenback strength additional fuel. While administration officials have stated that they would like to see a weaker currency, actions speak louder than words, and trade policies remain a wild card. But as long as policymakers take a measured approach on that front, which is our base-case expectation, the US dollar is likely to begin losing ground in the second half of the year. That's when large-scale monetary stimulus could start being pulled back in other places like Japan and the Eurozone.

At the same time, the current account surpluses of those jurisdictions will begin to be seen in starker contrast to the large deficit in the US, adding another layer of pressure to the US currency.

So whether it happens within the next month, or fairly soon thereafter, the US dollar has one more bout of strength left in it before it starts a longer-term slide against a number of other majors".

Copyright © 2017 CIBC, eFXnews™

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.