- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Bank of America Merrill expects a dovish message from ECB. How to trade?

Bank of America Merrill expects a dovish message from ECB. How to trade?

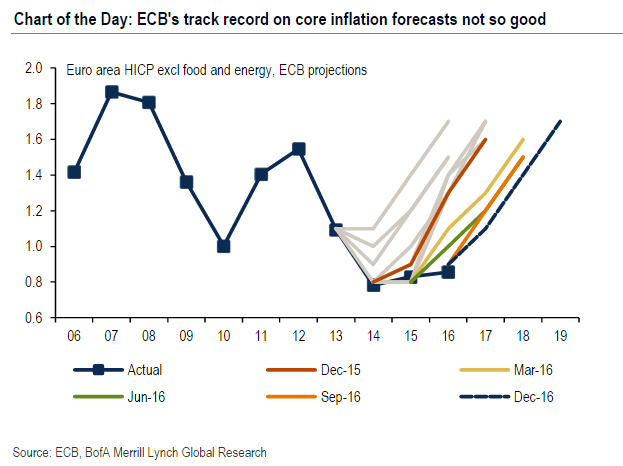

"We think the current "truce" between the hawks and doves will be reflected in a dovish tone by Draghi this week, with no decision. After the summer, though, we think a proper debate about the future of QE will be unavoidable. We expect the ECB meeting to be a non-event for the Euro. Draghi bought time when he extended QE by a year last December and he intends to use it. Eurozone data have continued to improve and headline inflation has reached 2%. However, core inflation remains below 1%, while headline inflation will decline later in the year, as the effect from higher oil prices fades. Draghi knows that he will face challenges later in the year, when markets will be looking for answers about the future of QE, but this is too far from now. Accordingly, we think the March ECB meeting should be a non-event.

The USD and European politics are the main EUR drivers for now. The Fed is the main USD driver, but we expect fiscal policy to become more important in early summer. The French elections have been weighing on the euro and we expect this to continue. Even if Le Pen has a very slim chance based on all polls, markets could get more concerned closer to the elections as her victory could eventually break up the Eurozone.

Assuming no surprises in the European elections, the Euro should gradually strengthen, particularly against JPY, as the market starts pricing the end of ECB QE".

Copyright © 2017 BofAML, eFXnews™

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.