- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- NZ CPI supports analysts forecast for a series of rate hikes from RBNZ

NZ CPI supports analysts forecast for a series of rate hikes from RBNZ

New Zealand Consumer prices rose 2.2% in the September quarter, taking the annual inflation rate to 4.9%. This sent the kiwi 0.2% higher vs the greenback to print a fresh cycle high through 0.71 the figure.

The data came in as the highest level since 2011's GST related spike and was well above both the market and Reserve Bank of New Zealand's forecasts. Inflation pressures are broad-based which traders will now anticipate a more aggressive resolve by the central bank, underpinning the downside in AUD/NZD and upside in NZD/USD for the foreseeable sessions ahead.

Consumers Price Index, September quarter 2021

- Quarterly change: 2.2%

- Market expected +1.5% (Range 1.2% to 1.8%).

- Annual change:4.9%, RBNZ: 4.1%.

Analysts at Westpac released a note after the release and explained, ''inflation is being boosted by increasing supply-side pressures, including disruptions to global manufacturing and distribution, as well as increases in international oil prices. Those pressures have been reinforced by strong domestic demand, which has allowed many businesses to pass cost increases through to final prices.''

''Today’s result supports our forecast for a series of rate hikes from the RBNZ over the coming months.''

''Inflation is expected to remain above the RBNZ’s target band through much of the coming year as New Zealand continues to be buffeted by a perfect storm of inflation pressures. In large part that’s due to global supply disruptions and other supply-side pressures. Those pressures are likely to endure for some time yet, and could become even more pronounced over the coming months as we head into the holiday shopping season here and abroad.''

Meanwhile, analysts at ANZ Bank said, ''for the RBNZ, today’s data will only reinforce that hiking the OCR in early October was the right move.''

''Underlying inflation is too high, and further removal of monetary stimulus is needed to get things back on an even keel. With lockdown creating downside risks to employment and growth, uncomfortable trade-offs could quickly emerge. But with inflation this strong, the RBNZ won’t want to play fast and loose with their inflation-targeting credibility.''

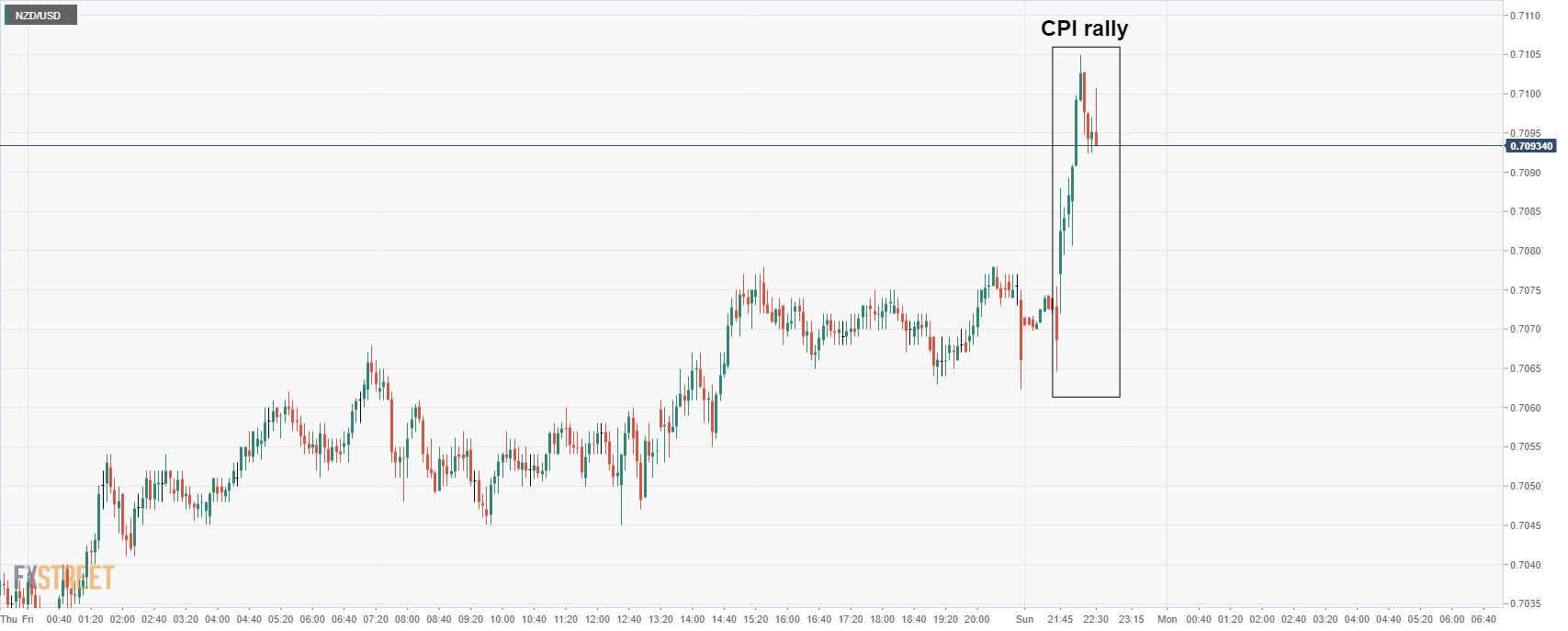

NZD/USD spiked

The data lead to a spike in NZD/USD as follows:

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.