- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- AUD/USD bulls pack-up for the day, just shy of 1 April pivot of 0.7532

AUD/USD bulls pack-up for the day, just shy of 1 April pivot of 0.7532

- AUD/USD has been in a parabolic daily rally that could face headwinds.

- US yields are trying to make a comeback and that should support US dollar.

AUD/USD has been an impressive show mid-week, rallying from a low of 0.7465 and reaching a high of 0.7522. It was a US dollar story to start the day with risk sentiment upbeat and as investors focused on rising commodity prices which supported the Aussie. Into the Wall Street close, the bulls are trying and have shied away from the 0.7532 target as the April 1 lows. Instead, the price is levelling out near 0.7520.

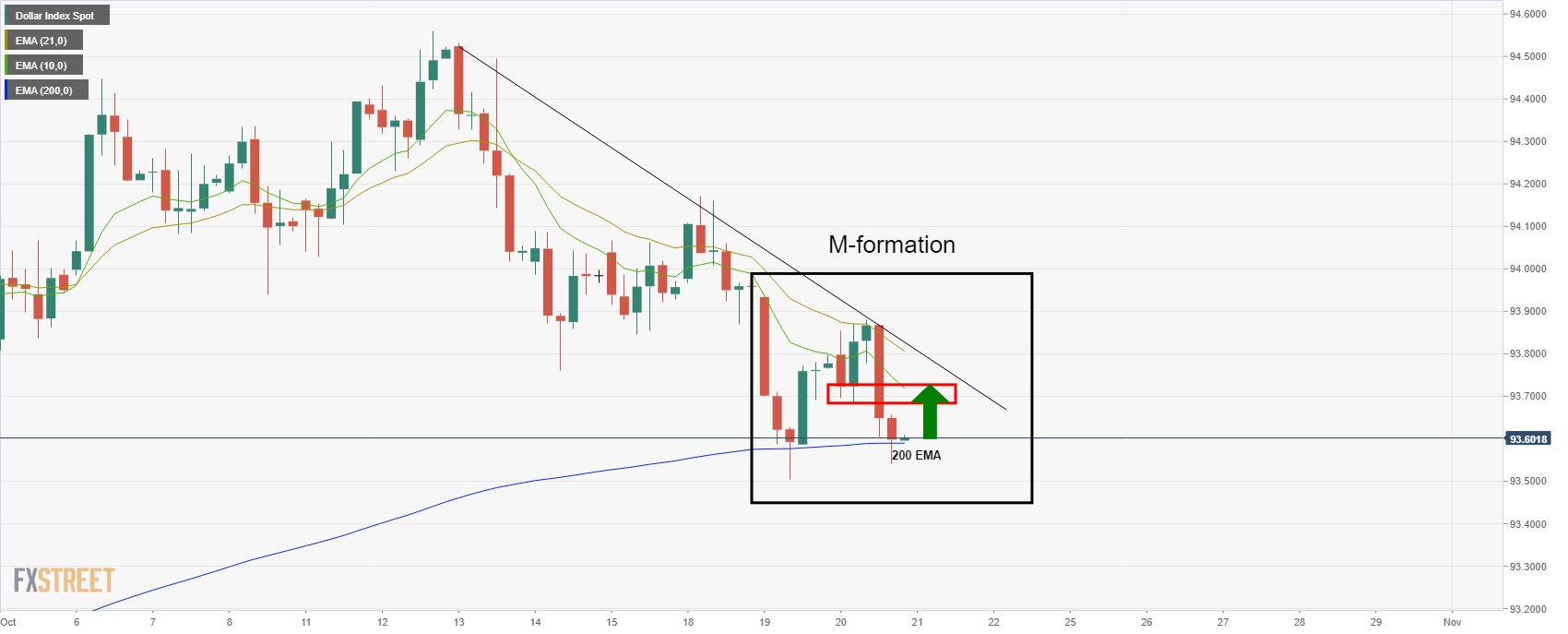

The US dollar fell from a one-year high against a basket of other currencies last week with other central banks also sounding the alarm with regards to inflation and a need to act. Both the Reserve Bank of New Zealand and the bank of England are expected to lift off immanently which has stolen the greenback's thunder of late. However, the Federal Reserve is also expected to raise rates sooner than expected to quell rising price pressures, so the Us dollar remains a strong contender for the leader board in the forex space also.

AUD/USD vs US yields

There is also a technical case for a rebound in the 10-year US yield which sank to 1.62% on Wednesday from a high of 1.673%. However, they are now steadied and could be on the verge of another surge to the upside from a technical perspective as the yield spikes from the 21-50 hour SMMA cloud and building demand at counter-trendline support following a break of the hourly flag resistance:

Should the US yields break higher and take the US dollar for a ride to the upside as well. This could prove a major headwind for commodity currencies for the end of the week's sessions.

Meanwhile, the markets are going to be watchful of Reserve Bank of Australia's governor, Phillip Lowe tomorrow who is making a speech, but he is unlikely to reference Australia's monetary policy specifically at the Conference on Central Bank Independence, Mandates and Policies. Next week's RBA’s November statement is the next key AUD risk event for this cross.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.