- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- US Dollar Index resumes the downside and approaches 93.60

US Dollar Index resumes the downside and approaches 93.60

- DXY fades Thursday’s advance and returns to 93.60.

- US yields fade part of the recent upside on Friday.

- Flash PMIs next of relevance in the US docket.

The US Dollar Index (DXY), which gauges the greenback vs. a bundle of its main rival currencies, resumes the downside and re-visits the 93.65/60 band at the end of the week.

US Dollar Index looks to data, yields

The index quicky fades Thursday’s uptick and resumes the downtrend at the end of the week, retesting at the same time the vicinity of the 93.60 region on Friday.

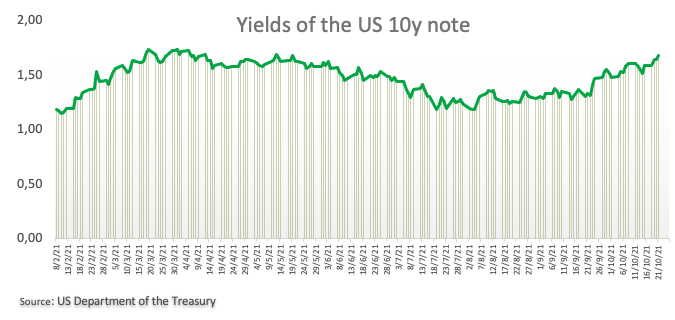

The resumption of the offered stance in the buck comes in response to the pullback in US yields from recent tops: the front end of the curve recedes to the 0.45% yardstick, while the belly and the long end retreat to the 1.68% area and to the 2.12% zone, respectively.

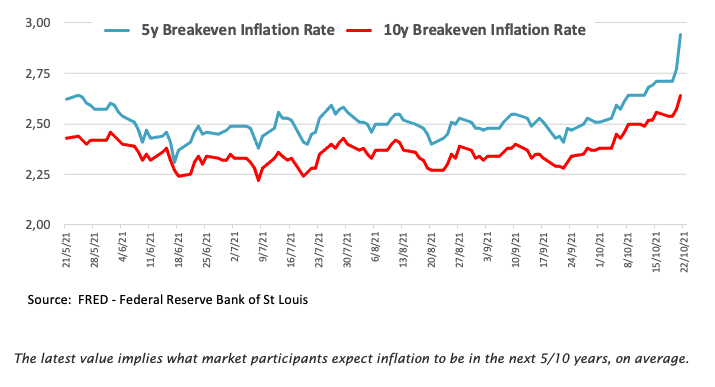

In the meantime, inflation concerns return to the fore following the abrupt increase in the 5y breakeven to the boundaries of the key 3.0% mark, while the 10y breakeven approach the 2.65% level.

Later in the US calendar, Markit will publish its preliminary PMIs for the month of October, in what will be the sole data releases on Friday.

What to look for around USD

The index remains under pressure and returns to the area of recent lows, always reflecting the performance of the US cash market. The corrective move in the dollar came in response to the repricing of several central banks particularly in light of elevated inflation and the subsequent improvement in the risk complex. Supportive Fedspeak, an anticipated start of the tapering process, higher yields and the rising probability that high inflation could linger for longer remain as the exclusive factors behind the constructive outlook for the buck in the near-to-medium term.

Key events in the US this week: Flash Manufacturing PMI (Friday).

Eminent issues on the back boiler: Persistent uncertainty around Biden’s multi-billion Build Back Better plan. US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. Debt ceiling debate. Geopolitical risks stemming from Afghanistan.

US Dollar Index relevant levels

Now, the index is losing 0.13% at 93.64 and a break above 94.17 (weekly high Oct.18) would open the door to 94.56 (2021 high Oct.12) and then 94.74 (monthly high Sep.25 2020). On the flip side, the next down barrier emerges at 93.49 (monthly low October 21) followed by 93.25 (55-day SMA) and finally 92.98 (weekly low Sep.23).

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.