- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Breaking: Aussie CPI Q3 trimmed mean hotter, AUD rallies

Breaking: Aussie CPI Q3 trimmed mean hotter, AUD rallies

Australia’s third-quarter Consumer Price Index has been released. AUD/USD has spiked on hotter trimmed mean data. Australian short-term bond yields are also up after annual trimmed mean inflation rise to the highest since 2015:

Aussie CPI Q3

Q3 RBA trimmed-mean CPI +0.7 pct QoQ (Reuters poll +0.5 pct).

Q3 CPI(all groups) +0.8 pct QoQ (Reuters poll +0.8 pct).

Q3 RBA weighted median CPI +0.7 pct QoQ(Reuters poll +0.5 pct).

Q3 RBA trimmed mean cpi +2.1 pct YoY (Reuters poll +1.8 pct).

Q3 CPI (all groups) +3 pct YoY (Reuters poll +3.1 pct).

Q3 RBA weighted median CPI +2.1 pct YoY (Reuters poll +1.9 pct).

There was more uncertainty than usual due to the lingering effects from the now-expired HomeBuilder grants and the ABS imputing price changes for some services, analysts noted prior to the data.

''The main downward offsets in Q3 are pharmaceuticals and communications.''

Additionally,m given New Zealand's surprise outcome for inflation, there was some prospect of a surprise to the upside for Australia's today.

''The big difference between Australia and New Zealand is that non-tradable inflation in Australia is expected to remain low, and we don’t expect that to change much until wages start to meaningfully accelerate,'' analysts at ANZ Bank argued.

AUD/USD implications

- Australian dollar aud=d3 rises to $0.7528 after inflation data

- Australian short-term bond yields up after annual trimmed mean inflation rise to highest since 2015.

- AUD/USD rallies 0.3% to test 0.7430s.

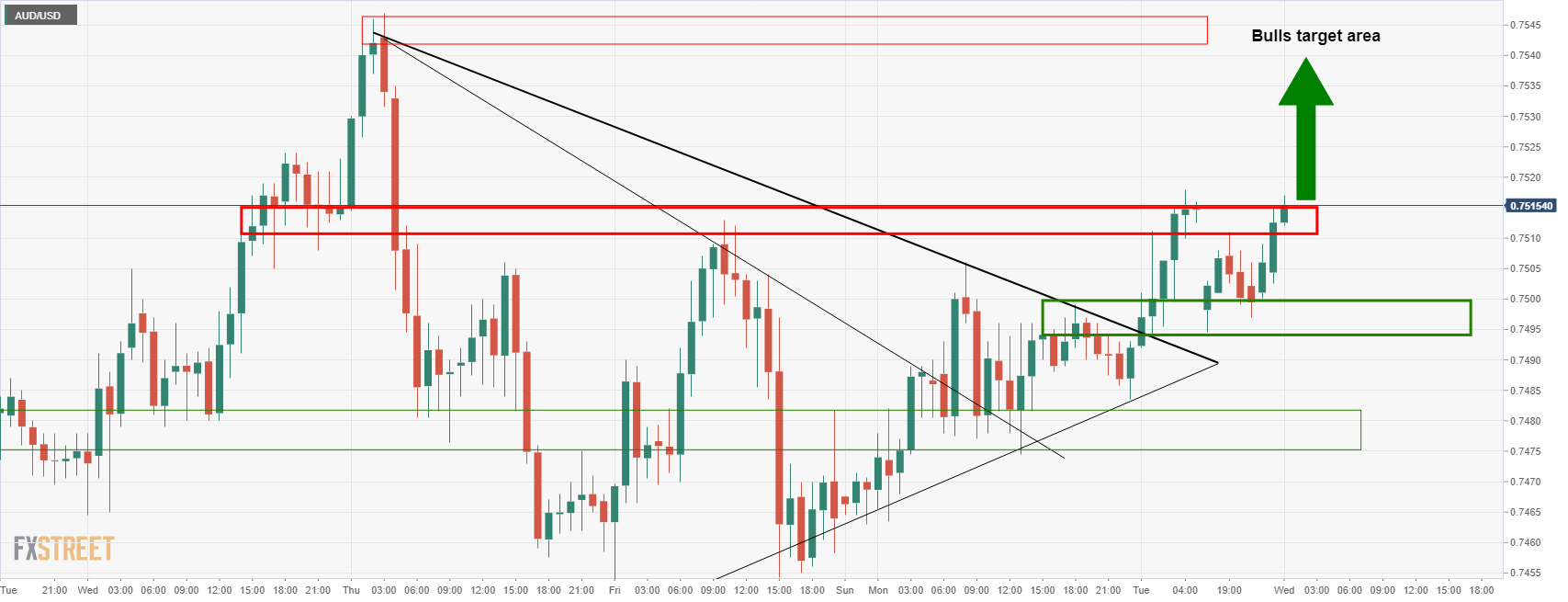

Prior to the data, the following analysis was performed on the 1-hour chart in order to highlight the market structure and potential areas for which price could move to, depending on the outcome:

- AUD/USD Price Analysis: Bulls in charge pre-CPI, eye 0.7530/50

Before...

After...

Meanwhile, the price is unlikely to go too far ahead of next week’s RBA decision.

About the Aussie CPI

Australian Bureau of Statistics (ABS) has a significant impact on the market and the AUD valuation. The gauge is closely watched by the Reserve Bank of Australia (RBA), in order to achieve its inflation mandate, which has major monetary policy implications. Rising consumer prices tend to be AUD bullish, as the RBA could hike interest rates to maintain its inflation target. The data is released nearly 25 days after the quarter ends.

The Consumer Price Index released by the RBA and republished by the Australian Bureau of Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The trimmed mean is calculated as the weighted mean of the central 70% of the quarterly price change distribution of all CPI components, with the annual rates based on compounded quarterly calculations.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.