- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EUR/USD looks offered, turns negative near 1.1650

EUR/USD looks offered, turns negative near 1.1650

- EUR/USD now faces some downside pressure around 1.1660.

- German flash Q3 GDP came at 2.5% YoY and 1.8% QoQ.

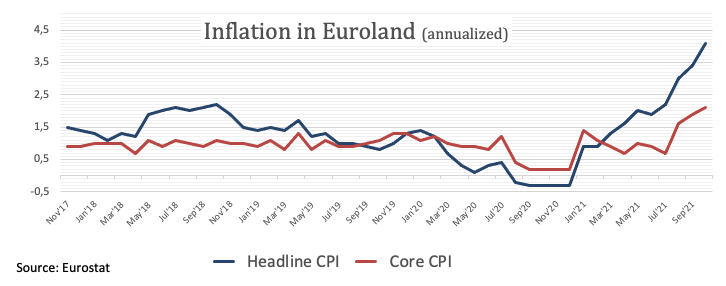

- Flash EMU CPI is seen rising 4.1% YoY in October.

Following another test of recent tops around 1.1690, EUR/USD now comes under some downside pressure and revisits lows near 1.1650.

EUR/USD: Upside seems capped near 1.1700

EUR/USD gives away part of the recent strong advance and recedes after two consecutive daily pullbacks, always on the back of some profit taking mood and a decent recovery in the greenback at the end of the week.

The corrective downside in the pair comes amidst a recovery in yields of the US 10y reference note and its German counterpart to 1.61% and -0.10%, respectively.

The pair, in the meantime, seems to have already digested the ECB event on Thursday, where Chairwoman Lagarde failed to push back market bets for a lift-off next year on a more convincing fashion.

On the ECB front, the Survey of Professional Forecasters (SPF) now see inflation at 2.3% in 2021 (from 1.9%) and 1.9% in 2022 (from 1.5%). Regarding the GDP, the economy is expected to expand 5.1% this year and 4.5% during 2022, while the Unemployment Rate is seen lower across all the horizons.

In the domestic docket, advanced GDP figures showed the German economy is expected to have expanded 2.5% YoY and 1.8% QoQ during the July-September period. In the broader Euroland, flash inflation figures see the CPI at 4.1% YoY in October and the Core CPI at 2.1% YoY.

Across the pond, the PCE, Personal Income/Spending and the final October U-Mich print are all due later in the NA session.

What to look for around EUR

EUR/USD met initial hurdle in the boundaries of 1.1700 in the wake of the ECB meeting. While the improvement in the sentiment surrounding the risk complex lent extra wings to the par in past sessions, price action is expected to keep looking to dollar dynamics for the time being, where tapering chatter and a probable sooner-than-expected lift-off in rates remain well in well in centre stage. In the meantime, the idea that elevated inflation could last longer coupled with the loss of momentum in the economic recovery in the region, as per some weakness observed in key fundamentals, is seen pouring cold water over investors’ optimism as well as bullish attempts in the European currency.

Key events in the euro area this week: Advanced German Q3 GDP, flash EMU CPI (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the region. Sustainability of the pick-up in inflation figures. Probable political effervescence around the EU Recovery Fund in light of the rising conflict between the EU, Poland and Hungary. ECB tapering speculations.

EUR/USD levels to watch

So far, spot is losing 0.21% at 1.1653 and faces the next up barrier at 1.1692 (monthly high Oct.28) followed by 1.1698 (55-day SMA) and finally 1.1755 (weekly high Sep.22). On the other hand, a break below 1.1582 (weekly low Oct.28) would target 1.1571 (low Oct.18) en route to 1.1524 (2021 low Oct.12).

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.