- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- AUD/USD meanders close to 0.7400 ahead of US inflation, Fed speak, Aussie jobs

AUD/USD meanders close to 0.7400 ahead of US inflation, Fed speak, Aussie jobs

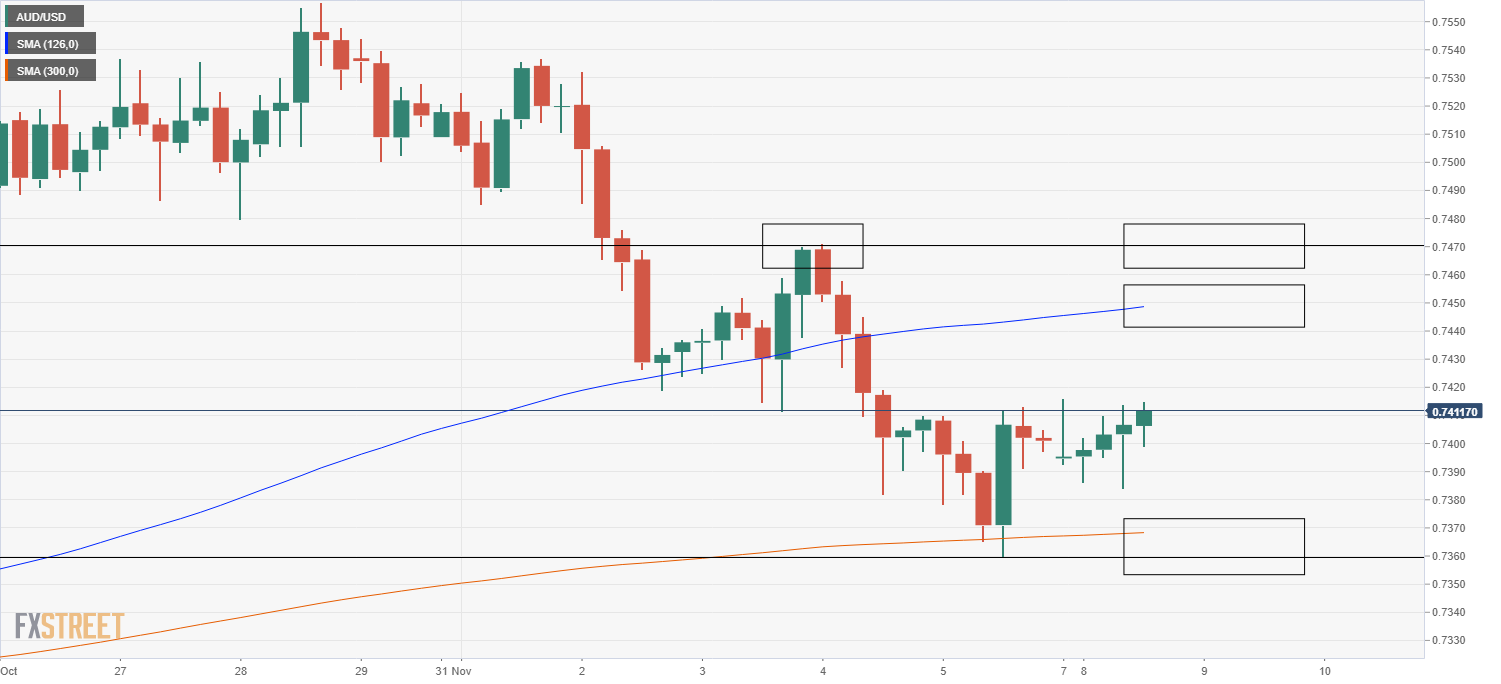

AUD/USD continues to meander close to the 0.7400 level, a level around which is has gently pivoted since the US dollar weakened in response to last Friday’s US labour market report (despite that report being stronger than expected across most metrics). In recent trade, it has pushed to fresh daily highs just above 0.7410, but isn't showing much conviction as of yet. The key levels that technicians will be watching this week are the 50-day moving average (DMA) at 0.7445 and last Wednesday’s high at 0.7470 to the upside and the 21DMA and last week’s low in the 0.7360 region to the downside. Chinese trade data overnight was mixed; exports beat expectations, but imports missed and, thus, given that China is a big export destination for Australian goods, this is a net negative for AUD. Analysts read the weaker than expected import data as further signs that Chinese growth momentum continues to weaken.

This Week

Last week was a hectic one, with the RBA and Fed both deciding on monetary policy and the end result being a sharp fall for the pair as a dovish RBA Governor Philip Lowe pushed back more aggressively against market pricing for rate hikes in 2022 than his Fed counterpart Jerome Powell. In the absence of key central bank events and the US labour market report, this week should be a calmer affair, though there are plenty of Fed policymakers speaking publically this (including a number throughout Monday’s US session) and US inflation data is set for release on Tuesday (the Producer Price Inflation report) and Wednesday (the Consumer Price Inflation report).

Meanwhile, Thursday sees the release of both Australian and US jobs data; the former is the official labour market report for Australia for the month of October and is expected to show employment rising modestly as lockdowns were eased, while the latter is the US September JOLTs report, which should show that labour demand in the US remains incredibly strong. Ahead of Aussie jobs on Thursday, the release of the NAB October Business Confidence survey during Tuesday’s Asia Pacific session and then the release of the Westpac Consumer Confidence survey during Wednesday’s APac session may trigger some AUD volatility.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.