- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EUR/NOK recedes from 2-day highs, remains capped by 9.9000

EUR/NOK recedes from 2-day highs, remains capped by 9.9000

- EUR/NOK adds to Tuesday’s gains around 9.8800.

- The 9.9000 region continues to cap the upside so far.

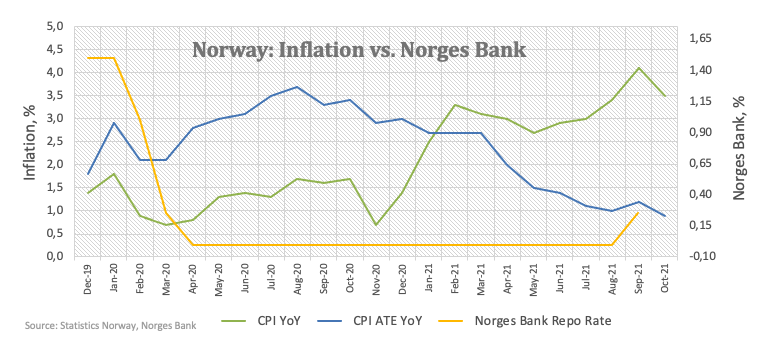

- Norway’s inflation figures surprised to the downside in October.

The Norwegian krone gives away further ground and pushes EUR/NOK to new 2-day highs in the vicinity of 9.9000 midweek.

EUR/NOK picks up pace after CPI, Brent

EUR/NOK gathers extra steam and adds to the recent advance, although the upside momentum seems to remain limited around the 9.9000 region for the time being.

The krone faces some selling pressure after inflation figures in the Scandinavian economy came below expectations in October. In fact, the headline CPI contracted at a monthly 0.3% and rose 3.5% from a year earlier. When measured by the CPI-ATE (CPI adjusted for tax changes and excluding energy products), the Norges Bank’s preferred gauge for inflation, prices rose 0.9% vs. October 2020. Still on inflation, Producer Prices rose 60.8% YoY.

Also weighing on NOK appears the downtick in prices of the European reference Brent crude, which drop to sub-$85.00 levels after three consecutive daily advances.

EUR/NOK significant levels

As of writing the cross is gaining 0.06% at 9.8704 and faces the next resistance at 9.9128 (monthly high Nov.5) followed by 10.0000 (round level) and then 10.0051 (55-day SMA). On the other hand, a breach of 9.7864 (20-day SMA) would open the door to 9.7197 (monthly low Nov.1) and finally 9.6624 (2021 low Oct.21).

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.