- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- NZD/USD Price Analysis: Key levels to watch into the RBNZ's Survey of Expectations

NZD/USD Price Analysis: Key levels to watch into the RBNZ's Survey of Expectations

- NZD/USD is trying to correct the bearish impulse.

- NZD/USD traders start to roll up their sleeves for RBNZ's Survey of Expectations

- Bears are looking for a downside extension while bulls are banking on a hawkish RBNZ hike.

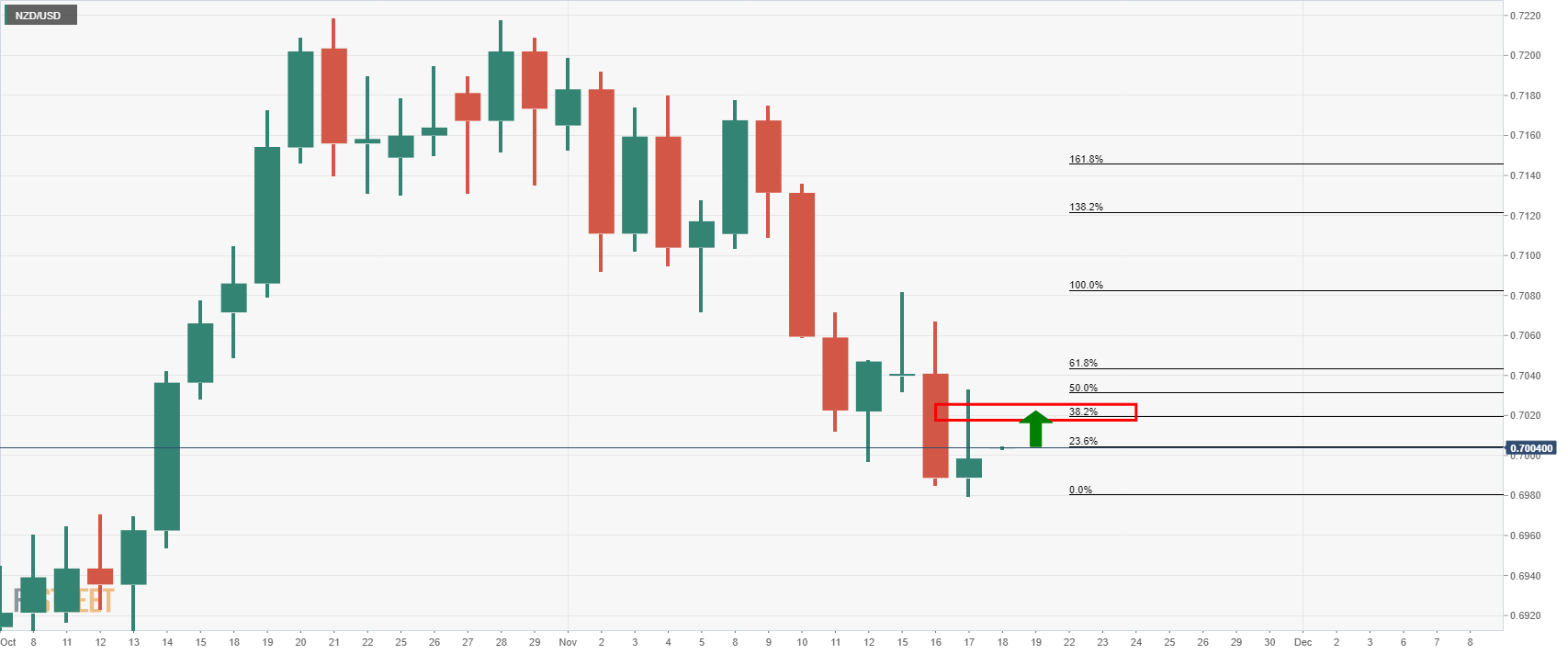

NZD/USD is in a precarious position on the charts as we head into the key event today, RBNZ's Survey of Expectations and before the forthcoming interest rate meeting. Today's event is watched closely for signs that expectations are drifting away from the 2% target.

''Market pricing is sitting at roughly 60/40 in favour of a 25bp hike vs 50bp, and we’re expecting a 25bp hike as well. We can’t rule out a 50bp move,'' analysts at ANZ Bank explained.

''But risks to employment and growth are at best balanced and at worst to the downside, and the construction sector is facing a lot of headwinds. Moving in well-signalled 25bp increments can achieve a similar tightening in financial conditions compared with a 50bp hike, but without jolting the economy as much.''

The following is a breakdown of the market structure ahead of these events.

NZD/USD daily chart

NZD/USD is on the verge of a deeper correction to test the 38.2% Fibonacci retracement level near 0.7020 which could be the last stop ahead of a downside continuation. A break of the current lows opens risk to the 0.6950's at least:

However, should there be renewed speculation that the RBNZ is about to hike by 50bps, then the upside will most definitely be to play for in the kiwi. With that being said there could be better places to go and trade the kiwi against, such as AUD for the divergence of central banks.

In such a scenario, 0.7100 will be eyed vs the greenback:

For the upcoming event, we have two areas of resistance at 0.7040 and 0.7020:

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.