- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD/TRY recedes from daily highs near 11.2000

USD/TRY recedes from daily highs near 11.2000

- USD/TRY adds to the rally above the 11.00 mark

- The lira remains under heavy fire following the CBRT rate cut.

- The resumption of the dollar buying pushes spot higher.

The lira extends its march south and now pushes USD/TRY to daily tops near 11.2000, where some resistance appears to have turned up for the time being.

USD/TRY up on lira weakness, dollar uptrend

USD/TRY advances for the ninth consecutive session on Friday, always on the back of the indefatigable lira selloff although this time the strong upside in the greenback also helps the pair extending the rally.

Indeed, the ongoing context favours the risk aversion and therefore lends extra legs to the buck despite US yields trade on the defensive so far on Friday.

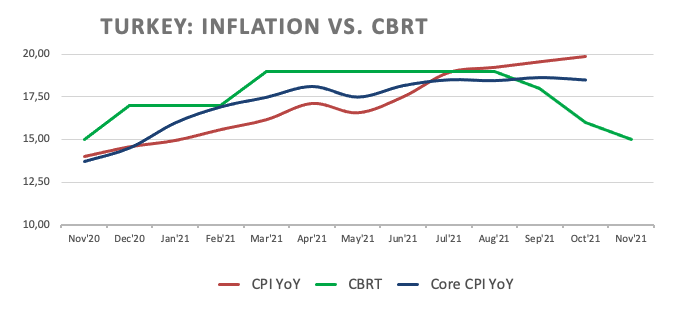

The pair, in the meantime, trades a tad below Thursday’s all-time highs near 11.2800, recorded in the aftermath of another reduction of the One-Week Repo Rate by the Turkish central bank (CBRT) at its meeting. Losses in TRY has been also exacerbated after the central bank left the door (wide) open to another interest rate cut at the December event.

The lira has so far shed more than 33% vs. the US dollar and remains the worst performing EM currency by far this year. The last time the pair advanced for ten sessions in a row was back in 2019, from April 18th until May 1st. We’re just there… about to break another record.

USD/TRY key levels

So far, the pair is gaining 0.35% at 11.1152 and a drop below 10.2276 (10-day SMA) would expose 9.8325 (high Oct.25) and finally 9.4722 (monthly low Nov.2). On the other hand, the next up barrier lines up at 11.2792 (all-time high Nov.18) followed by 12.0000 (round level).

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.