- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- NZD/USD is on te forex watchlist, RBNZ showdown this week

NZD/USD is on te forex watchlist, RBNZ showdown this week

- NZD/USD volatility is on the cards this week around the RBNZ.

- 0.7220 and 0.6800 are daily swong levels eyed depending on the outcome.

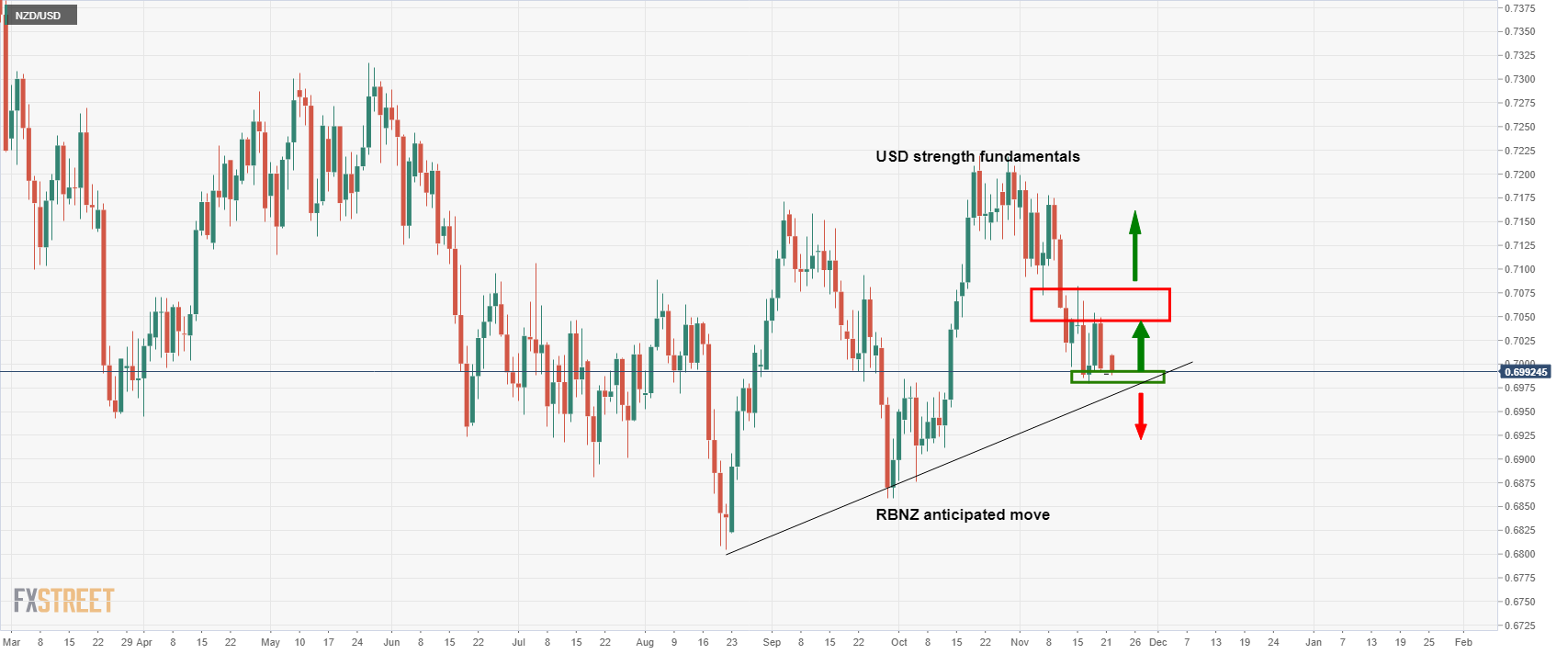

NZD/USD is sitting near 0.7000 in the open and seemingly resistant to the US dollar's strength despite the risk-off mood. On Friday, the pair shed around 20 pips but eld up relatively well as traders position for higher interest rates in New Zealand ahead of this week's Reserve Bank of New Zealand meeting.

''Whippy price action looks to be on the cards this week,'' analysts at ANZ Bank said noting that markets are split on whether the RBNZ will deliver a 25bp or 50bp hike on Wednesday. ''Fireworks are all but guaranteed no matter what they do,'' they added.

''Markets seem to be becoming a bit glass-half-empty, and we wouldn’t be surprised if 25bps puts the NZD under pressure on the view that interest rate support isn’t as strong. Or ironically, 50bps might be viewed as the straw that breaks the proverbial camel’s back for the economy. But it might be a lot simpler than that: other countries are normalising too, and that could eat into New Zealand’s erstwhile lone star power.''

Meanwhile, analysts at TD Securities concede that 50 bps is a possibility given the surge in inflation expectations and the red-hot labour market. The analysts argue that the Bank risks missing its medium-term remit. ''If our baseline pans out, the Bank could signal a more rapid path to neutral,'' and this ''is likely over coming meetings once the economic recovery gains momentum as current COVID restrictions ease.''

NZD/USD technical analysis

The price is meeting support following the recent daily sell-off on USD bullish fundamentals. A break of the trendline support opens risk to the downside towards 0.6800 while a break of the recent highs should clear the way to the October highs near 0.7220.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.