- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EUR/USD ranges above 1.1200, unmoved by ECB minutes, as case for near-term consolidation grows

EUR/USD ranges above 1.1200, unmoved by ECB minutes, as case for near-term consolidation grows

- EUR/USD continues to trade slightly to the north of the 1.1200 level and did not react to the ECB minutes.

- Technical indicators increasingly point to near-term consolidation following the pair’s recent run of losses.

EUR/USD has not seen any notable reaction to the release of the latest ECB minutes, which did not contain any surprises. The pair continues to consolidate slightly to the north of the 1.1200 level, with the euro one of the better performers in G10 FX markets on Thursday amid otherwise broadly subdued trading conditions. Volumes are thin given that US market participants are away for Thanksgiving and US markets shut.

Historic losses

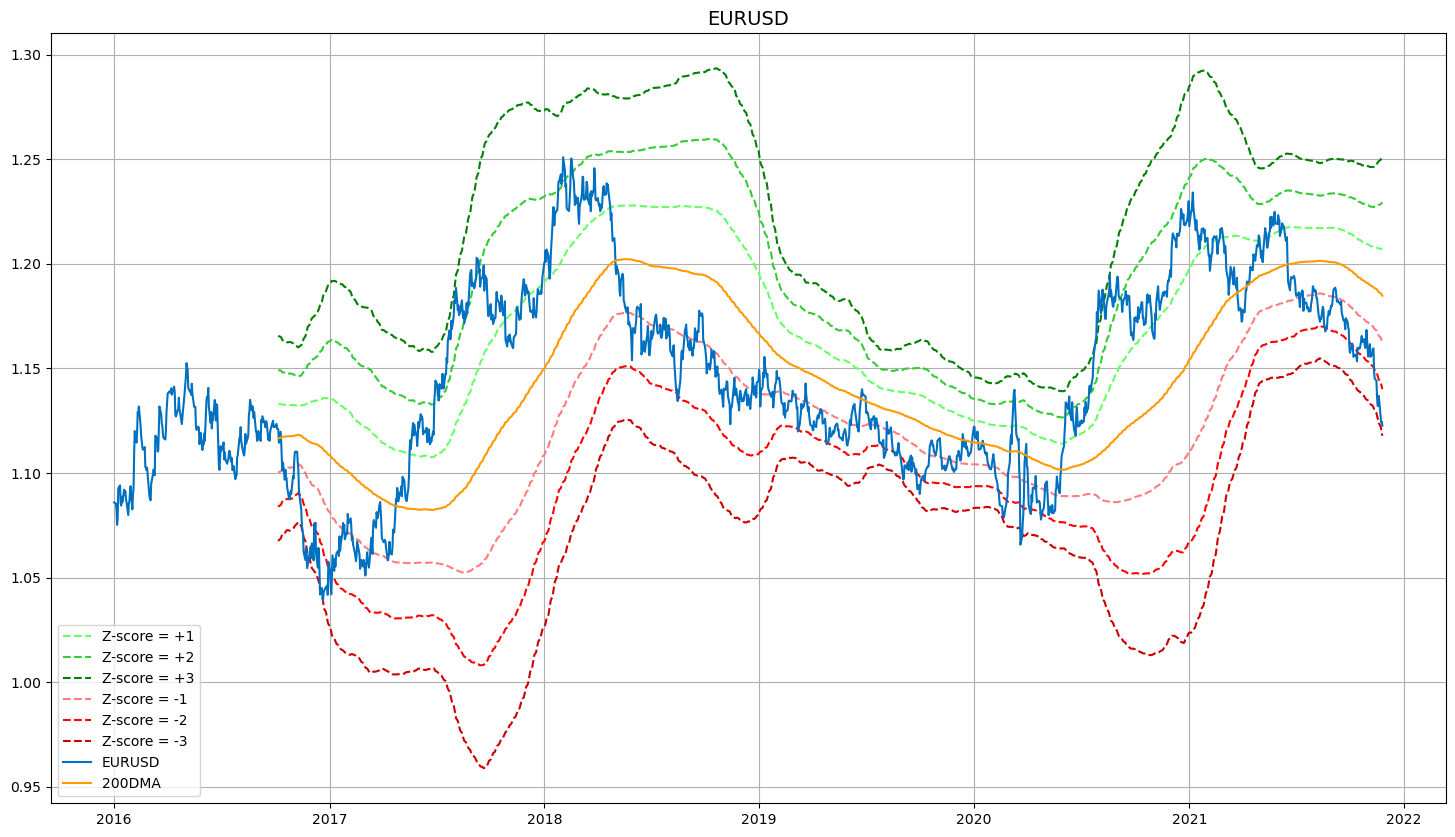

EUR/USD’s 3.2% drop over the last 21 trading session ranks in the second from bottom percentile, when compared against the rolling 21-session change over the past five years. Moreover, the pair on Thursday was trading more than 5.0% below its 200DMA, which ranks in the bottom percentile when compared with EUR/USD’s rolling percentage differences to the 200DMA over the last five years.

Case for consolidation

But with the euro bears having thus far failed to push EUR/USD as low as the mid-June 2020 lows around 1.1170 this week and the euro looking increasingly oversold by most metrics. In all but one of the last nine-session, EUR/USD’s 14-day Relative Strength Index score has been under 30. A close at the end of this week abvoe 1.1200 might be taken as signal for short-covering.

Meanwhile, the pair’s Z-score to the 200DMA (the number of standard deviations away from it) is approaching -3.0. Over the last five years, a Z-score to the 200DMA at around -3.0 has been a good signal of near-term consolidation lays ahead, or in many instances, a substantial bounce. The mean five-day return in EUR/USD from days when its Z-score to 200DMA was below -2.5 is +0.4%, while the mean 21-day return is 0.3% and the mean 65-day return is 1.3%. The case for near-term consolidation is clearly growing.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.