- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Gold Price Analysis: Bears are looking for a break of daily dynamic support

Gold Price Analysis: Bears are looking for a break of daily dynamic support

- Gold struggles in the region of the $1,780 support area as the US dollar picks up a bid.

- US yields are higher as fears of the Omicron impact are dialled back.

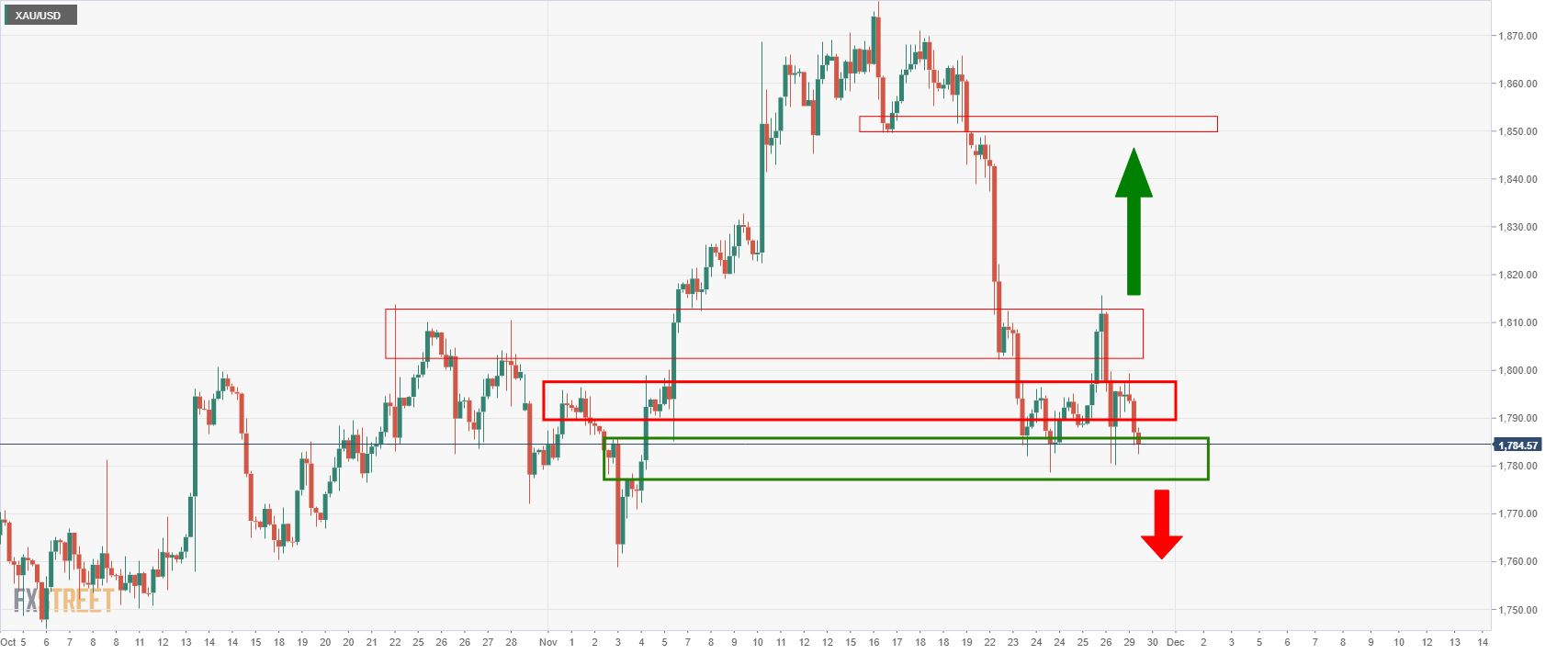

Gold is resuming the downside, although it could be carving out a trendline to the upside in what appears to be a dynamic support line. However, a meaningful break lower from here will likely invalidate that technical argument which makes today's lows near $1,170 important for the week ahead. At the time of writing, the yellow metal is trading $1,784 and down some 0.5% so far. The price fell from a high near the psychological $1,800 as the US dollar firmed and risk sentiment recovered.

The markets are weighing how severe the economic impact would be from the Omicron coronavirus variant which is so far balanced following last week's market sell-off. The major risk-off theme supported the gold price momentarily but a semblance of calm returned to world markets. US Treasury yields and the US dollar have climbed while US stocks are back in the green which is weighing on the gold price.

World leaders are sounding optimistic that they can deal with the Omicron variant and as such, it has done little to impact Fed tightening expectations so far which is supporting the greenback. Sentiment in markets has been helped by the WHO; while urging caution, the organization noted that symptoms linked to the new strain so far have been mild. Additionally, Moderna added to the positive sentiment by predicting it would have a modified vaccine ready by early 2022.

As a consequence, the US ten-year yield is up 3.31% and that is helping the greenback to recover. After two straight down days, DXY is trading higher near 96.445 the high for the day so far after finding support near 96. Gold traders will be keeping an eye out for another test of last week’s high near 97 and then the June 2020 high near 97.802 will be in focus.

However, markets are on edge due to the uncertainty of what is a very fluid situation and traders will be scouting out for more news on the matter. As such, the safe havens will likely hold up for the tie being, although rallies could well be faded so long as the optimists stay in play.

Fed speakers will be important

This puts Fed speak this week high up on agenda for gold traders. We will hear from Fed’s John Williams, chairman Jerome Powell, and Michelle Bowman. Last Friday, Raphael Bostic played down the risk of the omicron variant. He said that is hopeful that the momentum of the US economy will carry it through the next wave of the coronavirus pandemic and that he remains open to accelerating the pace of the central bank's bond taper.

If the new Omicron coronavirus variant follows the pattern seen with previous variants, it should cause less of an economic slowdown than the Delta variant, Bostic said. "We have a lot of momentum in the economy right now," Bostic said during an interview with Fox News, citing strong jobs growth. "And that momentum, I'm hopeful, will be able to carry us through this next wave, however, it turns out." Other central banks have also been optimistic, such as the Reserve Bank of New Zealand. 'Chief Economist Ha said that the new variant would have to have a dramatic economic impact to prevent the bank from continuing to hike interest rates.

Gold technical analysis

The daily chart is carving out dynamic support that is coming under pressure.

The 4-hour chart indicates to be long above $1,810 and short below $1,780 and again below $1,770. Between these levels, traders will be at risk of whipsaw price action and sideways consolidation. From a shorter-term perspective, the 15-min chart indicates to be long above 1,785 to target between 1,791 and 1,795.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.