- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Silver under pressure as Fed's Powell confirms hawish bias despite covid threats

Silver under pressure as Fed's Powell confirms hawish bias despite covid threats

- Silber bulls are stepping in as the greenback gives back territory to the stubborn euro.

- Eurozone data arrived hot and put the ECB's dovishness into question.

- if the ECB is seen to align with the Fed, euro can rally and the dollar will be pressured, helping commodities recover.

The price of silver was a touch lower on the day despite a strong rally in the US dollar. Equities sold off and bond yields lifted as Fed Chair Jerome Powell indicated the Fed might consider accelerating the taper of bond purchases as inflation persists. At the time of writing, the white metal is down some 0.33% after falling from a high of $23.312 to a low of $22.6935.

The greenback did not manage to stay on top for long as the eurozone data came in hot. This enabled the euro to correct a strong sell-off considering the European Central Bank may not be able to ignore the risks of higher inflation for longer. Inflation in Europe hit a record in November with the headline inflation up 4.9% YoY and core inflation up 2.6% YoY. At this point, the ECB continue to insist the current high rate of inflation will not persist. On the same day, there was better news on the Unemployment Rate in Germany as well. The Unemployment rate fell in Germany by 0.1% to 5.3% in November as claims decreased by 34k. This data was slightly better than expected but ''Germany’s labour market still has some way to go to fully recover'', analysts at ANZ Bank argued.

Meanwhile, this morning the Fed Reserve Chair Jerome Powell conceded that it is time to talk about a fast rate of tapering. he noted that inflation can no longer be considered “transitory” as the risks of persistently higher inflation have grown.

''Despite the market uncertainty caused by the emergence of the Omicron variant of COVID, Powell indicated it may be time to further curb the rate of bond purchases,'' analysts at ANZ Bank explained.

''While this form of monetary policy tightening had previously been announced, Powell now says the bond purchase programme may need to end sooner than previously signalled. He stated that the economy is very strong and inflationary pressures are strong therefore it is appropriate to consider wrapping up the taper of asset purchases a few months early, and this will be discussed at the next Fed meeting.''

The analysts argued that this indicates the bond purchase programme may be wrapped up by March 2022 with the final purchases occurring in February.''

Consequently, the DXy shot higher to test the 96.65 territories. The euro, however, was above to battle back in a 61.8% Fibonacci retracement and this weighed don the greenback that fell back to test 96 the figure towards the close on Wall Street.

Meanwhile, analysts at TD Securities explained that the selling flow from China Smart Money funds has continued to weigh on silver, with the group substantially growing their short during the commodity carnage in last Friday's session.

''Interestingly, the recently added Shanghai gold length has remained resilient to the technical failure, but Shanghai silver traders' growing short fits with our view of a more vulnerable fundamental outlook for the white metal, despite the resiliency thus far observed in price action.''

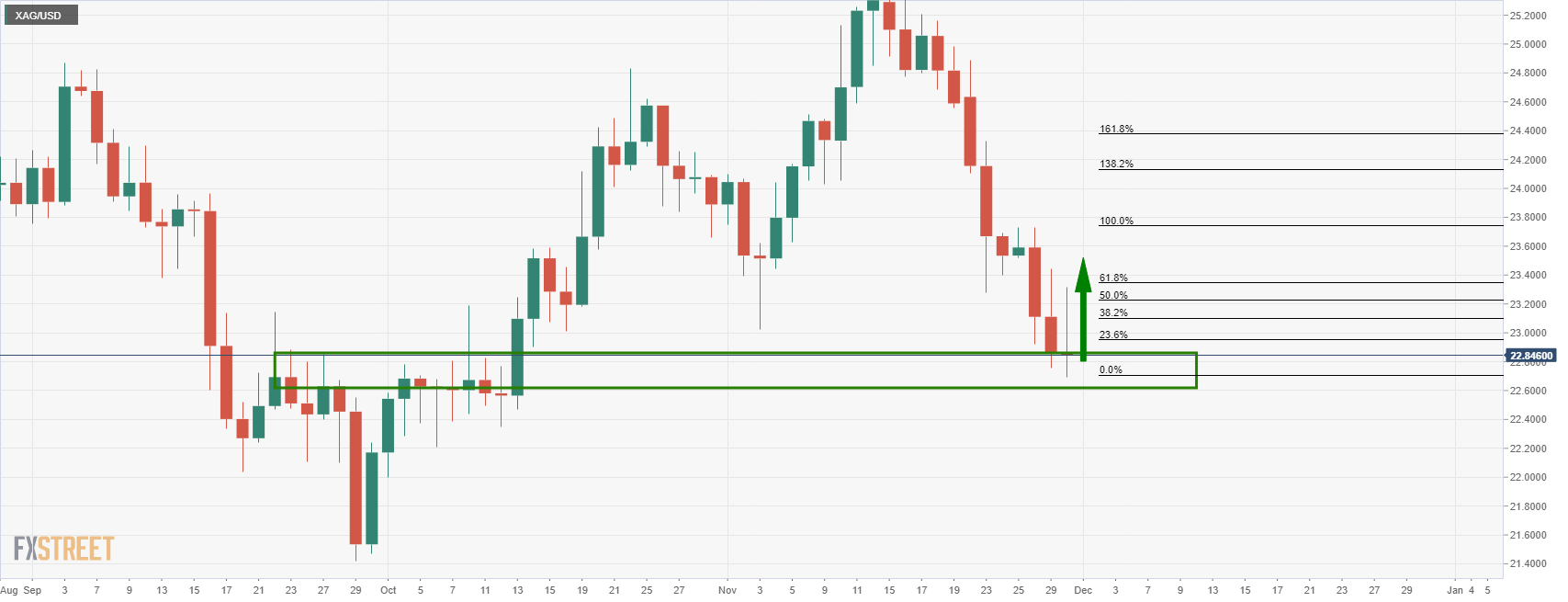

Silver technical analysis

As the dust settles, the bulls will be looking for a correction, potentially as far as a test of the 61.8% golden ratio and into the prior support structure near $23.60. A break of the current support, however, opens risk to a run into the $21.50 regions.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.