- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EUR/USD bulls keep the pace up, eye 1.1300

EUR/USD bulls keep the pace up, eye 1.1300

- EUR/USD is attempting to move higher despite the bearish prospects on the hourly chart.

- Risk-on themes are making their way through to Asian markets on Wednesday.

The greenback in sliding in Asia and the euro has extended gains on a strong hourly impulse that started in the early hours of the Nother American session on Tuesday. Concerns over the severity of the omicron virus strain continued to fade which supported riskier asset classes. China also announced measures to boost economic growth which lifted stocks and fed through into the forex space.

At the time of writing, the single currency is on the front foot vs the greenback, printing a fresh corrective high in Tokyo of 1.1277. The US dollar index is down on the day and extending its losses from overnight despite the Federal Reserve Chair Jerome Powell's hawkish stance.

Meanwhile, US stocks rallied the most in nine months, with major averages rising at least 2% on hopes that the omicron variant will not derail global growth. Consequently, US treasuries fell, causing two-year yields to reach their highest level since March 2020. The CBOE volatility index also fell five points to 22 as the risks of the covid variant abate.

In terms of data, the US trade deficit shrank, while third-quarter productivity fell. Private consumption was the most important driver of the eurozone's most recent economic expansion. In the eurozone, Industrial Production in Germany outperformed in October gaining 2.8% MoM. However, the ZEW Survey of Expectations for December weakened from the previous month but was stronger than expected.

US CPI eyed

Looking ahead for the week, the US Consumer Price Index will be key. ''We expect inflation to slow significantly as fiscal stimulus fades and supply constraints ease, but we don't expect the data to be validating in the near term,'' analysts at TD Securities explained. ''The CPI likely surged in Nov, with a drop in oil coming too late to avert another large gain in gasoline and core prices boosted by rapidly rising used vehicle prices and post-Delta strengthening in airfares and lodging.''

EUR/USD technical analysis

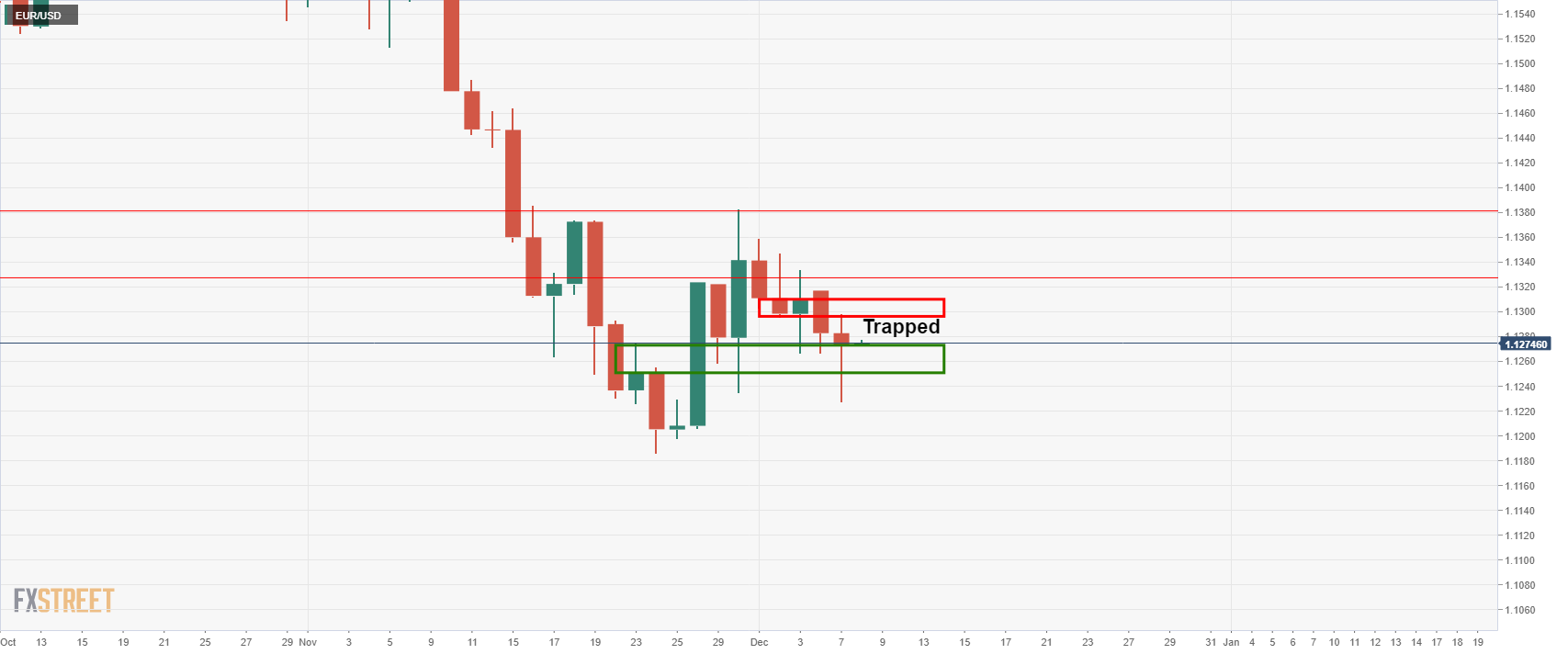

From a daily perspective, the price is trapped between support and resistance with 1.1300 the upside target, as per the following line chart's analysis:

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.