- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

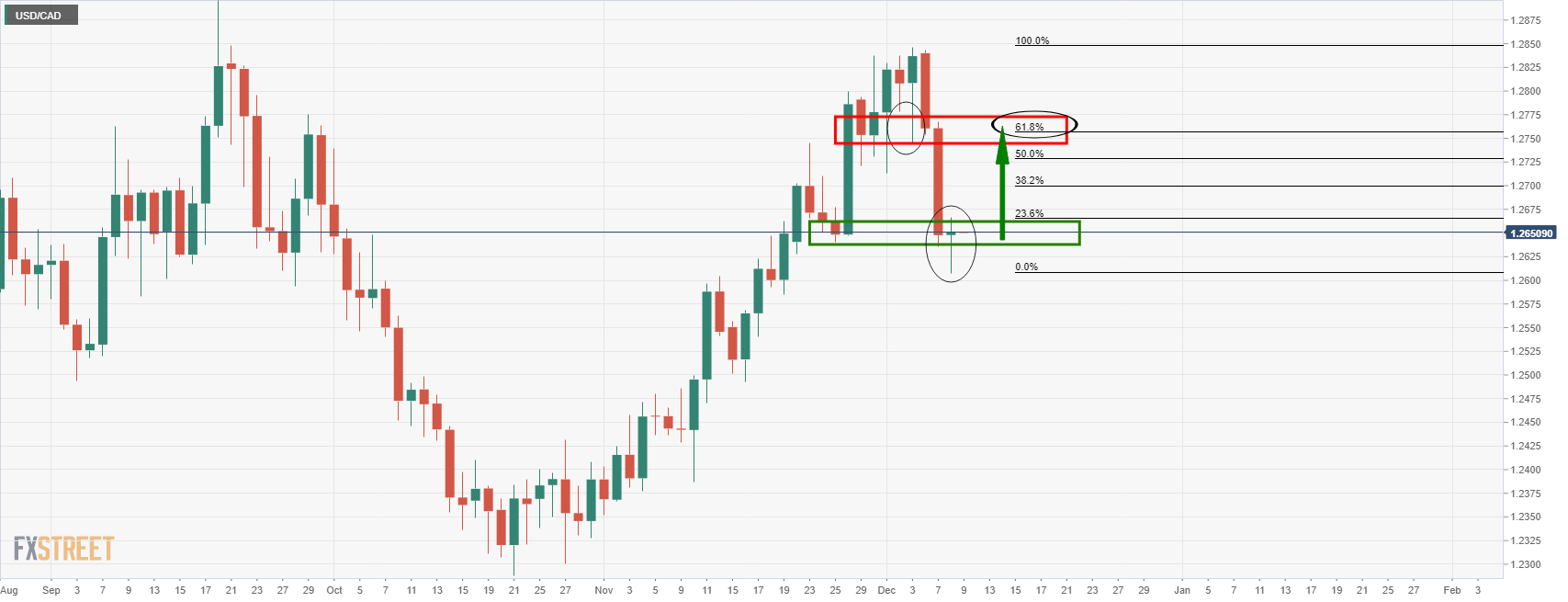

- USD/CAD bulls steping in and eye correction towards 61.8% golden ratio

USD/CAD bulls steping in and eye correction towards 61.8% golden ratio

- USD/CAD bulls looking for a significant correction in the days ahead.

- Hourly inverse H&S is compelling in USD/CAD, eyes on daily 61.8% Fibo.

- US CPI is the next key event following BoC and ahead of Fed next week.

USD/CAD popped and stopped overnight as the Bank of Canada left interest rates unchanged although signalled concerns over elevated inflation that could persist longer than previously thought. USD/CAD ended around 1.2650 after reaching a high of 1.2666 on the day.

The stag is being set by the BoC for a shift in policy early next year. Inflation “is elevated and the impact of global supply constraints is feeding through to a broader range of goods prices,” governor Tiff Macklem wrote in the central bank's updated statement. “The effects of these constraints on prices will likely take some time to work their way through, given existing supply backlogs.”

Nevertheless, the Lonnie fell as traders that had positioned for a more hawkish outcome pulled their positions expecting that the BoC will not move until at least the second quarter of 2022. “We will provide the appropriate degree of monetary policy stimulus to support the recovery and achieve the inflation target,” the central bank reiterated in its new statement.

Key themes in play

Meanwhile, risk appetite remained resilient amid Omicron vaccine optimism which helped Wall Street, Treasury yields and commodities extended their recent gains. The greenback subsequently fell as traders looked ahead into the US Consumer Price Index on Friday and a series of BoE, ECB, and Federal Reserve rate decisions the following week.

USD/CAD daily chart

The price is meeting support at this juncture and a reversal in the US dollar is all that would b needed to see the price correct and potentially move in towards the 61.8% Fibonacci retracement level.

USD/CAD H1 chart

The inverse head and shoulders pattern on the hourly chart is a potentially bullish prospect for the sessions ahead.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.