- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EUR/USD well supported above 1.1300 in subdued, holiday-thinned trading conditions

EUR/USD well supported above 1.1300 in subdued, holiday-thinned trading conditions

- EUR/USD is trading in subdued fashion though remains well supported to the north of the 1.1300 level.

- The pair has formed an ascending triangle in recent sessions but is likely to remain within recent ranges into 2022.

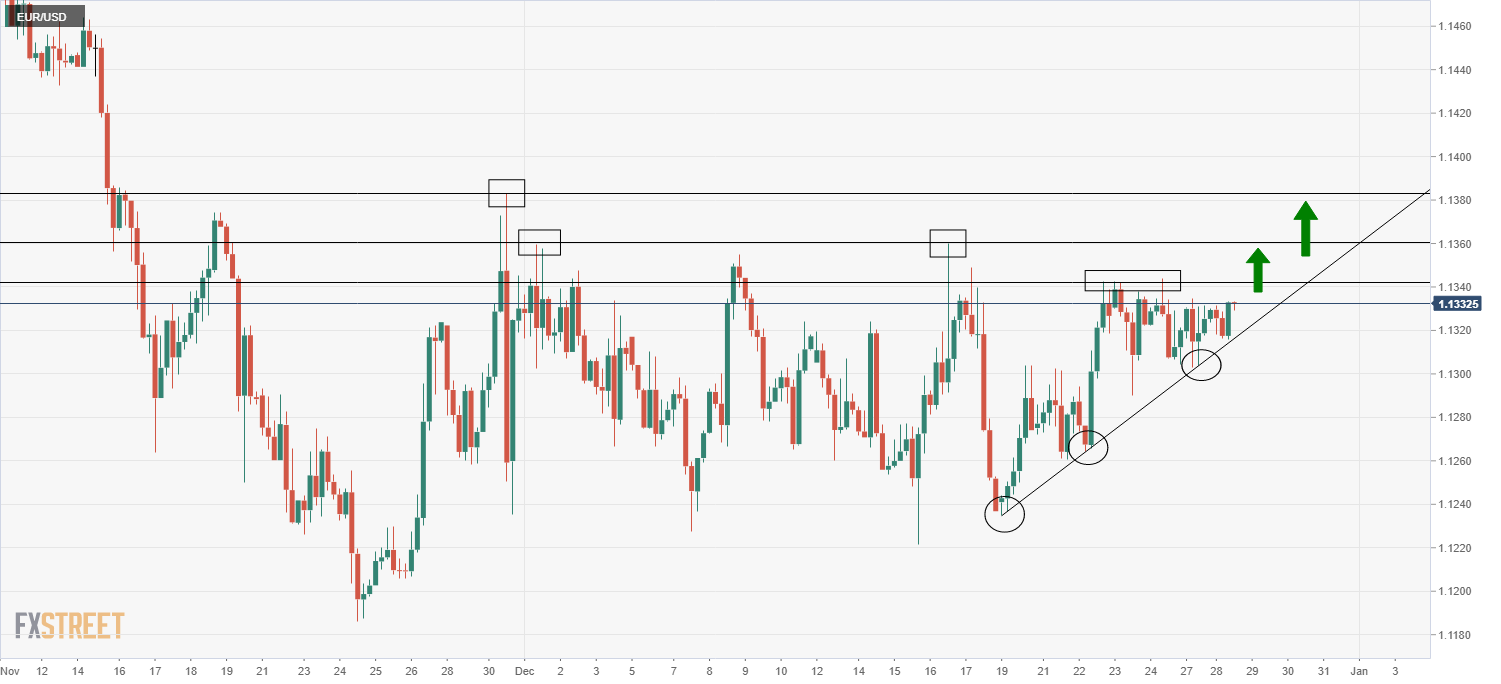

EUR/USD is currently trading just below highs of the week in the 1.1330 area, amid subdued, holiday-thinned trading conditions. The pair has traded with a modestly positive trading bias this week amid broadly risk-on conditions (stocks and commodities have been moving higher), which seems to have weighed slightly on the buck and looks set to remain well supported above 1.1300. Indeed, this is where the 21-day moving average currently sits, with the moving average having offered good support in recent sessions.

As strategists had been expecting, EUR/USD continues to trade well within the 1.1240-1.1360ish range that has prevailed for most of the month. This range is likely to hold until 2022 gets underway and market participants return and volumes go back to normal. Indeed, the first week of January will be a big one with the release of the December US jobs report and ISM manufacturing and services PMI surveys all due. This week there is very little US data of note aside from the usual weekly jobless claims report on Thursday. The Eurozone economic calendar is a little more interesting with the preliminary estimate of December HICP scheduled for release on Thursday.

Looking at EUR/USD from a technical standpoint, the pair is eyeing a test of last week’s highs in the 1.1340s, a break above which would bring in focus a test of December highs in the 1.1360s-80s area. Indeed, the pair does appear to have formed an ascending triangle in the latter stages of the month, which often is indicative that a bullish break is in the offing. Should the recent upwards trendline be broken to the downside, this would be a bearish sign that EUR/USD may be headed back under the 1.1300 level.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.