- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- AUD/USD supported on bids near 0.7180 ahead of first key data of the year from China

AUD/USD supported on bids near 0.7180 ahead of first key data of the year from China

- AUD/USD holds off from breaking below 0.7180 ahead of key data events.

- Chinese Manufacturing is coming up today while traders await critical US data as well.

AUD/USD has been in the hands of the bears to start the year as the US dollar firms along with US yields. For Tuesday, the price is holding above critical support near 0.7180 while bears step off the gas ahead of key data events that start today in China's Caixin Manufacturing PMI for December.

China data in focus

Based on a survey of 430 industrial businesses In China, the Caixin Manufacturing PMI Purchasing Managers' Index evaluates the efficiency of the manufacturing sector. This data is often regarded as a leading indicator for global growth. The Aussie is a high beta currency and would be expected to react to such data. Moreover, China is Australia's largest trading partner.

- China: Four reasons why growth could be better than expected in 2022 – Morgan Stanley

However, the data could be ignored in part as traders look ahead to the positive implications of the action that Chinese policymakers have already taken to help improve prospects for growth in 2022 and beyond.

The Chinese have ''hit pause on their deleveraging efforts and have already started to ease both monetary and fiscal policies in the last few weeks,'' analysts at Morgan Stanley explained.

“China’s zero-Covid approach has prevented disruptions to factory production and even led to a rise in its share of global exports.”

“A favourable global backdrop should further drive strong trade growth.”

Nonetheless, there will be no surprises if we see some expansion moderating the data today. ''In Nov all country PMIs were in expansion but rising Omicron concerns could weigh on sentiment in Dec. While we expect further expansion, some moderation is likely,'' analysts at TD Securities argued.

US data eyed

Looking elsewhere, the US calendar kicks off this week as well. The highlight will be Friday's jobs data in the form of Nonfarm Payrolls. ''The late-December COVID surge likely came too late to prevent a pickup in US payrolls after the gain in November (210k) appeared to be held down by an overly aggressive seasonal factor,'' analysts at TD Securities said.

meanwhile, the Federal Open market Committee minutes will also be a key event. ''Following the FOMC's decision to double the pace of QE tapering and the projection of a significantly more hawkish dot plot, focus will now turn to the elements that led to the evolution of views among policymakers (including on "maximum employment") after the November meeting,'' the analysts at TDS explained.

AUD/USD technical analysis

AUD/USD Price Analysis: A fast trip to 0.7150 is on the cards on a break of 0.7180

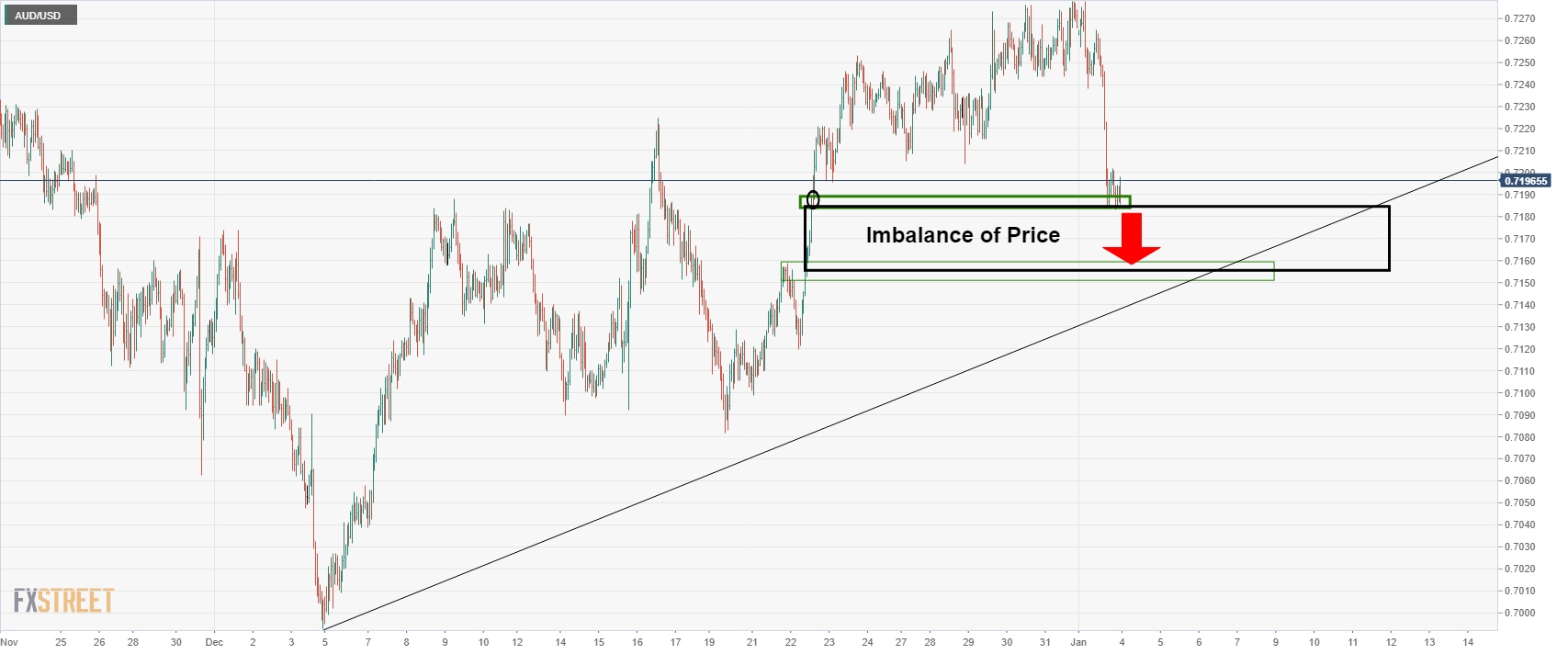

The bears have backed off from key support at this important juncture of the bearish impulse. However, if 0.7180 should give, then this could lead to a breakout and opens risk towards 0.7155 in mitigation of the price imbalance between here and there as illustrated above.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.