- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Gold Price Forecast: XAU/USD approaches $1,805 hurdle on softer yields, Fed's Powell, inflation eyed

Gold Price Forecast: XAU/USD approaches $1,805 hurdle on softer yields, Fed's Powell, inflation eyed

- Gold extends two-day rebound from a monthly low, recently picking up bids.

- Market sentiment dwindles amid inflation, Fed rate hike chatters.

- Fed’s Powell cites upbeat economic momentum, robust labor market to back the pledge against inflation.

- Gold Price Forecast: Quick pullback from 1,800 area hints at further slides

Gold (XAU/USD) picks up bids to $1,802 during a quiet Asian session on Tuesday, keeping the previous two-day advances.

The bullion rose during the last two days as markets braces for this week’s US inflation data and the US Treasury yields have been on the defensive despite the refreshing multi-day high of late.

The gold’s latest upside takes clues from mildly bid S&P 500 Futures and softer US 10-year Treasury yields. That said, the US stock futures rise 0.12% while the benchmark bond yields drop one basis point (bp) to 1.77% after easing from the yearly peak the previous day.

Behind the recent market optimism are the hawkish comments from Fed Chair Jerome Powell, per the prepared remarks for today’s Testimony. The Fed Boss said, “The economy is growing at its fastest rate in years, and the labor market is robust,” to back his pledge to stop higher inflation from getting entrenched.

Additionally, comments from Merck’s official saying, “Expect Molnupiravir mechanism to work against omicron, any covid variant,” could also be cited as positive for the risk appetite.

Previously, steady US inflation expectations, as per 10-Year Breakeven Inflation Rate numbers from the Federal Reserve Bank of St. Louis (FRED), joined higher inflation components of the December NY Fed’s survey of consumer expectations to portray inflation fears. The same propelled US bond coupons to refresh multi-day peaks and drown the equities before providing a mixed daily closing.

Looking forward, gold traders will keep their eyes on Powell’s testimony for intraday moves even as the prepared remarks are out. However, major attention will be given to Wednesday’s US Consumer Price Index (CPI) data for fresh impulse.

Read: Inflation and rising yields to guide investors

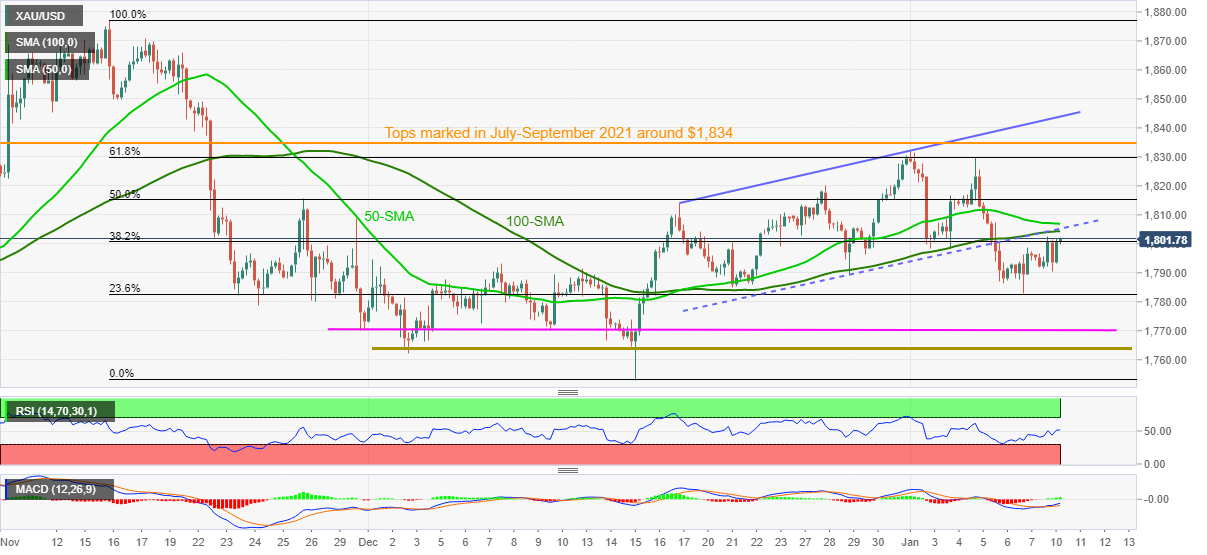

Technical analysis

Having confirmed a bearish bias by breaking a short-term ascending trend channel and 100-SMA support, gold prices bounced off 23.6% Fibonacci retracement (Fibo.) of November-December declines. However, the metal remains below a convergence of the stated support-turned-resistance, around $1,805, amid sluggish MACD and RSI lines to keep sellers hopeful.

That said, the 23.6% Fibo. retest, near $1,782, acts as immediate support during the quote’s fresh declines, before directing gold bears towards the $1,770 and $1,760 levels.

In a case where gold prices remain weak past $1,760, December’s low of $1,753 and September’s bottom surrounding $1,721 will be in focus.

Alternatively, recovery moves remain elusive below $1,805 resistance confluence, previous support. Also challenging gold buyers is the 50-SMA near $1,808 and 50% Fibonacci retracement level of $1,815.

Given the gold buyer’s dominance past $1,815, 61.8% Fibonacci retracement level around $1,830 may act as an immediate resistance before the tops marked in July and September of 2021, close to $1,834. Also acting as an upside filter is the upper line of the ascending trend channel, close to $1,843.

Overall, gold’s failure to keep Friday’s corrective pullback hints at the commodity’s further weakness.

Gold: Four-hour chart

Trend: Further weakness expected

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.